NJGOP Says Murphy’s Budget Lacks Transparency

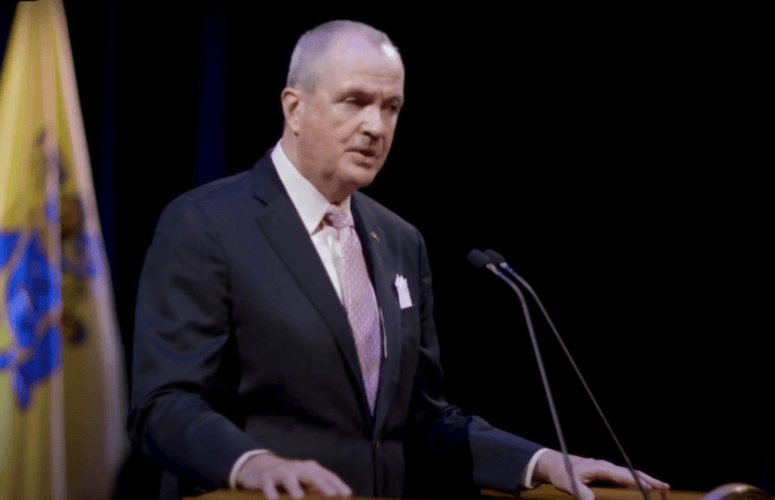

By Jim Pytell, Managing Editor On Mar 1, 2023New Jersey Republicans responded to Gov. Phil Murphy’s proposed FY2024 budget, and the theme in their reactions included a lack of transparency by the administration as well as a need for more sustainable, structural change to make the state more affordable and ease the tax burden on New Jerseyans.

“This is a government that has increased spending 53% in the last six years – that is an absurd amount,” said Republican Budget Officer Hal Wirths (R-24). “We need structural reform instead of giving people checks back of their own money after you overtax them.”

One example of such structural reform is the indexing of income tax brackets, which Republicans argue would go a long way in providing inflation relief to New Jerseyans.

“This is a simple solution employed by both the federal government and 37 other states to protect low- and moderate-income workers and families from the harmful impact of tax bracket creep,” said Senator Anthony M. Bucco (R-25). “There’s also no deduction for charitable donations to the nonprofits that serve our communities. These charitable organizations provide important services in hundreds of communities that government agencies would otherwise have to provide at taxpayer expense.”

Corporate Business Tax (CBT) Surcharge

Another highlight of the budget was the CBT surcharge; and while its sunset is welcomed by the business community, Republicans say it needs some perspective.

“Governor Murphy signed the CBT surcharge into law and broke his promise by extending it for years until the end of 2023,” said Senator Doug Steinhardt. “He doesn’t deserve a pat on the back for finally keeping his word to let it expire years late.”

“[The governor] also claims that this budget includes a corporate tax cut when in reality it just doesn’t raise a new one,” added Assemblyman Christopher DePhillips (R-40). “The truth is that New Jersey is still dead last for business climate and this administration has not helped make the state any more competitive.”

“While this surcharge was always supposed to be temporary, we recognize the sunset of a tax is never a given. So, it is appreciated,” said Michele Siekerka, president and CEO of the New Jersey Business & Industry Association (NJBIA). “As New Jersey will still have the fourth highest CBT rate in the nation and highest in the region without the surcharge, and with neighboring states like Pennsylvania on a path to cut its rate to 4.99%, we do believe a long-term, comprehensive plan to further reduce our CBT is an appropriate discussion worth having and something we will continue to strongly advocate for.”

DePhillips echoed this sentiment, and said it is imperative that policies are put in place to attract and retain business, and that can only be accomplished by actually cutting the corporate business tax, not just letting the surcharge sunset.

“I am once again renewing my calls on Legislative leadership to post my bill for consideration, so we can improve our economy and keep families in the Garden State,” he said.

DePhillips’ bill (A-1146) would gradually lower the New Jersey corporate business tax from 9% to 2.5% in four years – matching North Carolina’s lowest-in-the-nation rate. The rate for businesses making less than $100,000 would be reduced from 7% to 2.5% in just two years.

“The extra revenue from the high corporate tax rate is not worth the fall out. We are hurting hardworking, regular families,” DePhillips argued. “The best way to stem outbound migration is to promote a vibrant economy with tax cuts, not more spending and disingenuous talking points.”

Debt and Pandemic Funds

Senator Declan O’Scanlon (R-13) also argued that more transparency is needed when it comes to debt and pandemic relief funds.

“We support paying down debt, but we shouldn’t put billions into an opaque slush fund controlled by Democrat party bosses,” said O’Scanlon. “There’s no guarantee any of the money will be used to pay down debt. It can just as easily be used to fund pork projects favored by Democrat bosses and falsely billed as ‘debt prevention.’ That remains true for billions in remaining pandemic relief funds as well.”

O’Scanlon said that transparency and oversight of the process for approving the use of such funds needs to increase substantially.

“Proposed uses of debt and pandemic relief funds should be approved by the full Legislature after open public hearings. The current closed Joint Budget Oversight Committee process is ripe for abuse,” he added.

To access more business news, visit NJB News Now.

Related Articles: