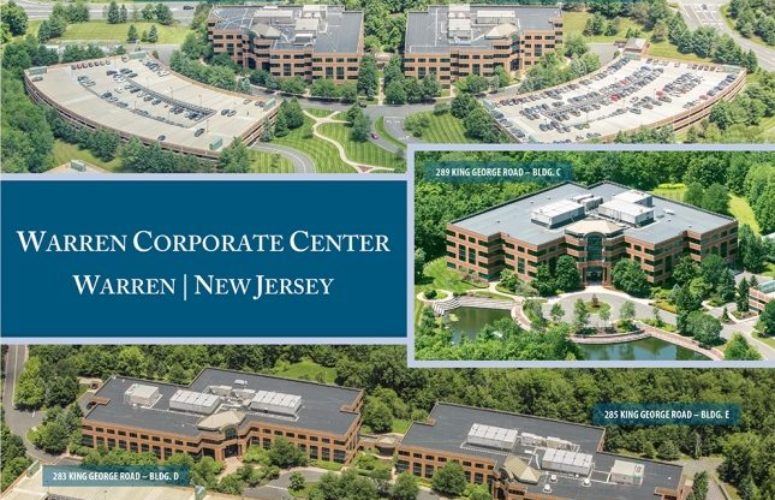

CBRE Announces $136 Million Sale of Warren Corporate Center

On Mar 29, 2016CBRE Group, Inc. announced that Jeffrey Dunne, Kevin Welsh, and Brian Schulz of CBRE Institutional Properties, in collaboration with Jeremy Neuer of CBRE’s East Brunswick office, represented Northwestern Mutual Real Estate in the $136 million sale of Warren Corporate Center in Warren. The team was also responsible for procuring the buyer, a joint venture between Vision Real Estate Partners and Rubenstein Partners. Jim Gunning and Donna Falzarano of CBRE’s Debt & Structured Finance Group also arranged a $123-million term loan, a portion of which is available for future capital, tenant improvements and leasing commissions led by Bank of America as administrative agent.

Warren Corporate Center is considered a best-in-class quality office development containing ±820,000 square feet across five, four-story buildings situated on a 176-acre site off of a full interchange on I-78. The Property was originally developed in 1996 as the headquarters of Lucent Technologies, and in 2004, Citibank fully leased the property and substantially improved the infrastructure with fully redundant power systems, supplemental cooling, and enhanced the amenities.

The property is currently 81 percent leased to Citibank, which terminated its lease on one of the five buildings providing the opportunity to shift from a single tenant headquarters environment towards a multi-tenant office park. Warren Corporate Center benefits from an expansive on-site amenity base including three full service cafeterias, three fitness centers, day care center, and 4/1,000 square-foot parking (90 percent provided in adjacent structured parking) within a natural campus setting. Located directly off I-78 (Exit 36) with proximity to I-287, Routes 202/206, and 22, the Property has a regional location within a strong Northern New Jersey submarket that has recently seen leasing success.

Mr. Dunne commented: “The acquisition of Warren Corporate Center provides Vision and Rubenstein with a premier office asset offering the opportunity to create a multi-tenant environment and potential for further modernization to meet the demands of today’s occupiers. Many businesses are seeking modern generation work environments that will attract and retain top talent.”

CBRE Institutional Properties specializes in the sale of investment properties in the suburban markets surrounding New York City, and also around the United States. CBRE Institutional Properties services a prestigious client base of institutions, corporations, private investors, developers and REITs and has closed over $9 billion in property sales in all property types over the last five years.

CBRE Institutional Properties has a number of attractive investment opportunities currently on the market, including: 80 Park Plaza, a 973,000 square-foot office building serving as the headquarters of PSE&G in Newark; 10 Mountainview Road, a 207,730-square-foot office building that is 56 percent leased in Upper Saddle River; 222/233 Mount Airy Road and 890 Mountain Avenue which are 59 percent leased in Basking Ridge and New Providence; and Country Club Plaza, a 300,260-square-foot office property consisting of two buildings that are 79 percent leased to a diverse tenant base in Paramus.

Related Articles: