49 Companies Approved to Sell $54.5M in Net Operating Losses, Tax Credits for Cash

On Mar 12, 2021The New Jersey Economic Development Authority (NJEDA) sent final approval letters last week to the 49 technology and life sciences companies that are participating in the 2020 Net Operating Loss (NOL) Program.

Hailed as a lifeline for New Jersey companies that have yet to reach profitability, the NOL Program enables participants to sell their New Jersey net operating losses and unused research and development (R&D) tax credits to unrelated profitable corporations for cash. The cash can then be used for working capital or to fund research. The NJEDA and the New Jersey Department of Treasury’s Division of Taxation jointly administer the program.

The average award for companies approved to sell their net operating losses through the program in 2020 was $1.1 million. Fourteen of the 49 participating companies set to receive funding are participating in the NOL Program for the first time.

To date, more than $1.07 billion in funding has been distributed to over 550 technology and life sciences companies since the program’s inception in the late 1990s.

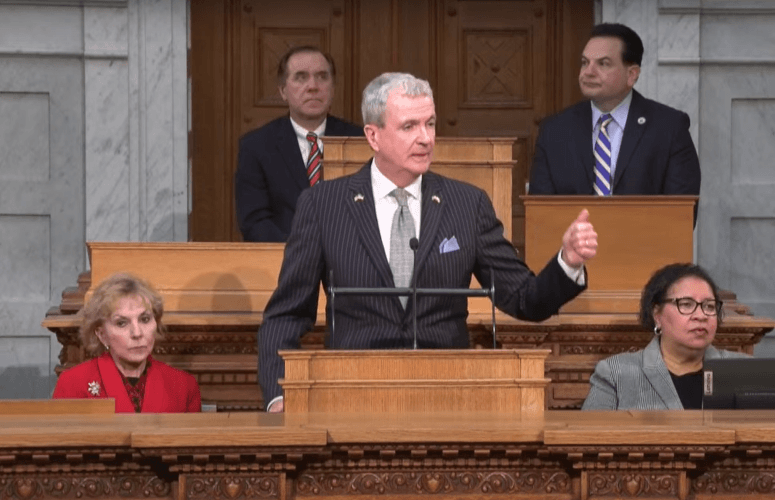

The NOL Program got a boost in January 2021, when Gov. Phil Murphy signed the New Jersey Economic Recovery Act of 2020. Part of the Act increased the program’s annual cap from $60 million to $75 million. It also increased the lifetime cap for an individual applicant from $15 million to $20 million.

“The NOL Program has historically been one of our most sought-after programs by entrepreneurs as they grow their companies here in the Garden State,” said NJEDA Chief Executive Officer Tim Sullivan. “Thanks to action taken by Governor Murphy and the Legislature, we will be able to connect even more companies with access to capital in the coming years. This, in turn, will lead to additional job creation within New Jersey’s innovation ecosystem and to the advancement of life-saving and life-enhancing technologies.”

Sullivan noted that the NJEDA plans to open the application for the 2021 NOL Program in early May.

In addition to being vital to emerging companies, the NOL Program also provides enormous benefits to the profitable companies that are buying the net operating losses and unused R&D tax credits. A profitable company can purchase tax credits at a discount, based on the market price at the time. These tax credits have traditionally traded somewhere between 88 and 94 cents on the dollar. Once purchased, the tax credits can then be applied to potentially reduce the buyer’s state tax obligation. The names of the buyers who chose to be publicly listed are on the NOL Program’s website.

Ailares Inc. in Princeton, Clinical Genomics in Bridgewater, and TrueFort in Weehawken, were among the 14 early-stage companies that were new to the NOL Program in 2020.

Ailares Inc. is a financial technology company that leverages machine learning (ML) and artificial intelligence (AI) in the fields of wealth management, investment management, and risk management. The company seeks to streamline the investment process for its clients by offering a platform that gives its user direct access to investment strategies and products.

“We founded Alaires with the goal of closing the wealth gap between those with access to ML/AI and those without it and to level the playing field for investors,” said Ailares CEO and Chief Investment Officer Kenneth Xu. “By leveraging the non-dilutive capital we receive through the NOL Program, we will be able to further our mission and connect every-day investors with the tools they need to invest strategically and successfully.”

Female-led Clinical Genomics, a biotechnology firm whose global headquarters are located in Bridgewater, develops technology to screen for, and monitor, colorectal cancer. Clinical Genomics’ products span the full spectrum of colorectal cancer testing from screening to post-treatment monitoring.

“New Jersey is home to the most scientists per square mile and top-notch resources like the NOL Program, which are tremendous assets for up-and-coming biotechnology companies like ours,” said Clinical Genomics President and CEO Betsy Hanna. “We have found the Garden State to be the perfect location to base our global operations as we continue to broaden access to our life-saving diagnostic tests for hospitals and testing facilities around the world.”

TrueFort develops cybersecurity software products used by enterprises to protect their critical business applications on premise and in the cloud. The TrueFort Fortress is a real-time enterprise security platform that defends high-value cloud, hybrid, and legacy environments from hidden risks using a unique application-centric approach. The company was founded by former information technology executives from JPMorgan Chase, Bank of America Merrill Lynch and Goldman Sachs. TrueFort announced last week it received accolades from Futuriom and the Cybersecurity Excellence Awards for its app and cloud workload protection innovations.

“This past year, more than ever, has shown the importance of keeping data safe in an increasing digital world,” said TrueFort President and CEO Sameer Malhotra. “We’re proud to be able to offer our clients peace of mind through our industry-leading technology. We are also grateful that the NJEDA’s NOL Program will enable us to keep building out our business as we expand our customer base.”

To access more business news, visit NJB News Now.

Related Articles: