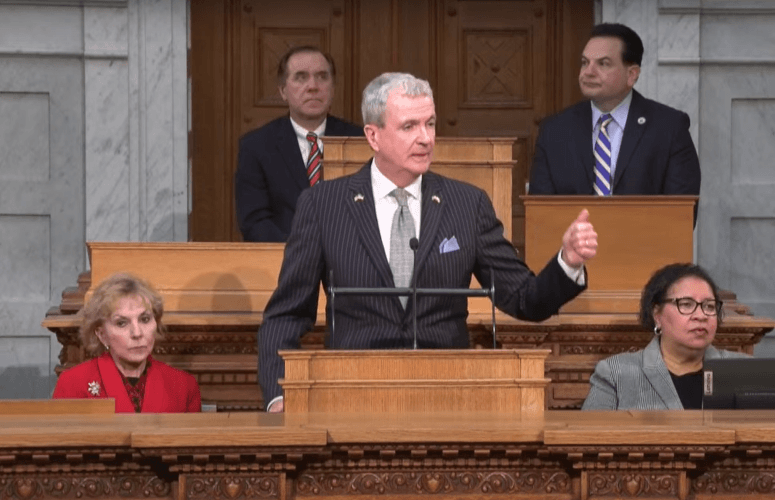

Gov. Phil Murphy’s Fiscal Year 2024 Budget Address as Prepared for Delivery

On Feb 28, 2023Below is Gov. Phil Murphy’s Fiscal Year 2024 Budget Address, as Prepared for Delivery:

Lieutenant Governor Oliver.

Senate President Scutari and Assembly Speaker Coughlin.

Majority Leaders Ruiz and Greenwald and Minority Leaders Oroho and DiMaio. My legislative partners, and especially the bipartisan escort committee which led me into this chamber.

Chief Justice Rabner and Judge Grant.

Members of the Cabinet. Senior Staff.

Former Governor McGreevey.

First Lady Tammy Murphy and our sons, Josh and Sam.

Distinguished faith leaders, honored veterans and first responders, leaders in organized labor, special guests, friends, and my fellow New Jerseyans.

It is my pleasure to present my proposed budget for the 2024 state fiscal year.

It is a budget designed with a singular purpose – to continue building the Next New Jersey.

A New Jersey where every family can afford to make their American Dream come true.

A New Jersey where every child can see their opportunity in our common future.

A New Jersey where our seniors can afford to retire and live with dignity.

A New Jersey that leads the nation in responsible, commonsense, and far-reaching solutions to the economic, social, and environmental challenges we currently face and is prepared to take on those not yet identified.

A New Jersey that attracts the world’s greatest companies and where small businesses can grow and succeed and, even more importantly, find the dynamic workforce they need.

And a New Jersey where every member of our statewide family is respected for who they are, who they love, where they came from, and how they live and worship.

This is the Next New Jersey.

A New Jersey that leads with compassion and understanding.

A New Jersey that invests in the futures of all of our people, not just some.

A New Jersey that lives up to its responsibilities and doesn’t push them off onto the shoulders of the next generation.

But here’s the thing – the Next New Jersey isn’t some far-off vision. The Next New Jersey is here and happening right now.

At the same time, I know some of you don’t feel certain of your place in that Next New Jersey.

First it was the pandemic and now it is inflation. You’ve been paying more for everything from gas to groceries, and your paycheck hasn’t kept up. It has been tough on your finances and your mental health.

This isn’t abstract to me. I remember, as a kid, growing up with a father who didn’t finish high school and a mom who worked as a secretary. Struggling paycheck-to-paycheck was a reality to keep food on our table and provide me and my three siblings with as good a life as possible.

These experiences helped define me. And these memories live large within me. They fuel my drive to ensure everyone has a place in that Next New Jersey.

So, know this – this budget was built with you in mind and to secure your place.

For the third year in a row, it has no new taxes and more middle-class tax relief.

It will help hardworking families by expanding free pre-K for your kids.

It will lower prescription-drug costs for seniors.

This entire budget is purpose-built to help you find your place in the Next New Jersey by securing your place in the New Jersey of right now.

Indeed, this is a budget focused on the pocketbooks of our families.

It provides more direct tax relief to help folks out from under stubborn inflation which makes it hard to cover the basics.

And with this budget, we will have cut taxes for our working and middle-class families, and our seniors, a total of 18 times since we began working together in 2018. Eighteen tax cuts.

Further, this budget will help insulate our state for uncertain economic times.

None of us hopes for an economic downturn. But should one occur, we will be on a far stronger footing to react in real time to ensure that critical investments can continue … that our economy can be backstopped … and that vital safety nets can be quickly put up so no one falls through the cracks.

This kind of rainy-day thinking had previously been absent in Trenton. It’s why, during past recessions, we were slow to react and even slower to recover.

But the Next New Jersey prepares for the future.

This is a future which we are determined to make more affordable and full of opportunity.

And one of the highest barriers to affordability in New Jersey is property taxes. We hear it from the people we meet. We know it ourselves.

So, this budget leads with historic property tax relief.

For far too long, leaders from both parties have stood at this podium talking around property taxes without actually doing anything real about them.

We stopped just talking about them and did something.

Working together – you and I – we have provided more property tax relief, to make living in New Jersey more affordable than any Governor and Legislature in history.

The facts bear this out.

Next month, more than 1.5 million families will receive direct property tax relief through the ANCHOR program we came together to create.

And the deadline for ANCHOR is midnight tonight. So, if you have not yet applied for your ANCHOR property tax relief, go to anchor.nj.gov.

Why?

A middle-class family making our state’s average household income of just under $125,000 and paying our statewide average of more than $9,400 in property taxes is going to receive $1,500 in direct relief – effectively pushing their property taxes down to a level not seen in a decade.

That’s right – for many homeowners their property tax burden is going to be lower than it was in 2013. That is action – not talk.

One of these recipients is Hazlet’s Michael Mattessich, who is with us today. And his ANCHOR benefit is going to greatly augment the $250 property tax deduction he also gets for being a U.S. military veteran.

Michael, thank you – and all our veterans – for your service.

For folks like Michael, the budget I am proposing will fully fund a second year of ANCHOR. That means a second year of direct property tax relief of up to $1,500 for homeowners and $450 for renters.

It means that in the past two years, we will have committed $4 billion to direct property tax relief, alleviating one of the single-greatest and longest standing affordability challenges our state faces.

But there are other challenges facing our families – like the cost of raising a child and access to child care.

When the federal government failed to renew the federal Child Tax Credit, we worked together to fill the void at the state level. And I welcome you to join me again in partnership to continue to support our families.

We all know New Jersey is the very best place in America to raise a family – and to make this fact ring true for more families, I propose doubling the state Child Tax Credit up to $1,000 per child.

This will give working and middle-class parents an even bigger tax break. And, for parents also juggling the cost of childcare, it will partner with our Child and Dependent Care Tax Credit to do even more to lower their costs.

We will also continue our work toward universal pre-K with a more than $1 billion total investment, an increase of nearly $110 million over this current year.

Pre-K isn’t just a smart investment in early childhood education – an investment proven to pay dividends throughout that child’s life. It’s also an investment in working families.

The cost of full-day child care can easily eat $20,000 of a family’s budget every single year – if not more. For many middle-class and working families, and especially for single parents, this cost can put high-quality child care completely out of reach.

And it leaves too many parents – disproportionately moms – with no alternatives than cutting back on hours or even leaving work entirely, putting their family’s financial future on hold.

So, every new seat we can create in a pre-K classroom makes life more affordable for working parents.

And as we stand with you as you raise your children, we are standing with you as you retire and spend time with your grandkids.

Let’s ensure more senior homeowners living on fixed incomes can stay in the homes they love – which are full of memories – and remain close to their families.

This budget will greatly expand the successful Senior Freeze property tax relief program – increasing income eligibility to $150,000 and removing roadblocks to eligibility. That means additional property tax relief for 50,000 more seniors.

This means even more direct property tax relief for folks just like Clinton Banks, who has lived in his Willingboro home for 43 years.

But our focus is not just in helping families and seniors stay in their homes. It’s also about helping young families find a place of their very own to call home.

So, today I ask you to join me in putting home-ownership back within reach of hard-working families through a $15 million investment in First-Generation Homebuyer Down Payment Assistance. This has been a key point of discussion by our Wealth Disparity Task Force.

Alam Nunez Delarosa is sitting up in the balcony – right next to Mr. Banks. He closed on his first home in Camden just two weeks ago – a home his three kids can call their own, too.

And he was able to buy that home because of our down payment assistance program. Now, we can help more homeowners just like him.

New families and longtime homeowners side by side. That’s what makes a community. This budget will see to it that our communities remain welcoming to every family.

But affordability doesn’t just come through what we can do, directly, for our families. Affordability is also found through the investments we can make to short-circuit rising taxes and costs in the first place.

And no investment has such an impact as the one we make in our best-in-the-nation public schools.

This budget will provide an additional $830 million in direct aid to our K-12 public school classrooms, for a total of almost $11 billion.

Making this investment will mean that in our six years of working together we will have increased overall K-12 support to our schools by more than $2.6 billion. That’s a more than 30 percent increase.

This support is also critical not just for keeping our public schools the envy of the nation – and lifting up others – but it will also help districts and educators continue to turn around the learning loss we know occurred when the pandemic forced our students to move to remote learning.

And to help push this effort further, this budget will commit $10 million more for high-impact tutoring to support the students who most need it. This ups our total investment in academic recovery to nearly $300 million.

If all this wasn’t enough – every penny we provide for our students, educators, and schools isn’t just an investment in the futures of our kids, communities, and economy, it’s also property tax relief that lifts more of the burden off the shoulders of local taxpayers.

There’s far more we can do to make our state more affordable and more investments we can make to fulfill the promise of the Next New Jersey. But we cannot make these investments unless our fiscal foundation is strong enough to sustain them. This is why this budget is also centered around fiscal responsibility.

We’ve embraced a radical philosophy for Trenton: Pay your debts and don’t spend more than you make.

Over the past five years we have strengthened our foundation more than any administration in decades, and this budget will continue to reinforce our fiscal standing.

And the proof of our renewed foundational strength is evident.

In a span of six months last year, New Jersey received three credit-rating upgrades. These were welcome news not just for the state, but for every taxpayer.

Our taxpayers get this. They know when their credit score goes up, their interest rates go down, and more of their money stays in their pockets. That means they can get more at the supermarket, or put more away for a child’s education, or for a new car or home.

It’s the same thing for the state – except we save money on things like new roads and bridges and new schools. And when we save money, every single taxpayer saves money.

We worked hard to put New Jersey in position to get its first credit upgrades in nearly two decades – and only a few short years after the prior administration oversaw 11 consecutive downgrades, leaving our credit perilously close to “junk” status.

But I am not ready to stop at three. So, this budget is designed to support the next round of credit upgrades. It is designed to build even greater confidence in our direction and in our ability to honestly meet our obligations.

To start, this budget will make the third consecutive full payment into our state pension funds – keeping our word and meeting our obligation to the many thousands of men and women whose work makes our state run and keeps our state safe.

This budget will also set aside more than $2.3 billion to either pay down existing debt or keep us from taking on new debt entirely.

But, moreover, this budget will better prepare New Jersey for any national or global economic uncertainty with a surplus of more than $10 billion – nearly 20 percent of this budget.

This surplus is 25 times greater than the one in the budget we inherited. That one had a surplus of roughly $400 million – or just one percent of that year’s budget.

Why is this important? Because for too long our fiscal house stood on a foundation of sand. Practically every year, the budget was signed knowing full well that the fiscal year would end in a looming deficit.

And because of that, faith in our finances was at an all-time low.

Unlike in Washington, we can’t get away with deficits. This surplus – all $10 billion-plus of it – is a signal to the credit rating agencies that we can pay our bills. That our foundation is strong.

Even more, it is a signal to our taxpayers that we treat every one of their tax dollars with the same care they do.

And no one deserves more credit in restoring our balance sheet than State Treasurer Liz Muoio and her tremendous team.

And because of this fiscal strength, this budget can take the steps necessary to secure more of our families in the Next New Jersey by making them secure in today’s New Jersey.

For our seniors, this budget will extend eligibility for the popular Pharmaceutical Assistance for the Aged and Disabled – PAAD – and Senior Gold programs to further cut the costs of life-enhancing, if not life-saving, prescription drugs.

Under PAAD, the average individual saves nearly $1,300 a year on their prescription drugs. That’s real money for countless seniors and others on fixed incomes. And together, we can allow even more New Jerseyans to enjoy these savings.

And to further increase prescription-drug affordability, I ask you to work with me by passing the legislative package currently before you so I can sign it into law – a package that, among other things, will help lower costs for more life-saving medicines such as Insulin.

We’re close to the finish line. Now let’s get across it.

For our college students, this budget will increase Tuition Assistance Grants for over 20,000 recipients. It will make even more students eligible for Community College Opportunity Grants and the Garden State Guarantee at our four-year institutions by increasing the income thresholds for both programs from $80,000 to $100,000.

For many students, this means they’ll be able to attain their degrees without paying one penny out-of-pocket for tuition.

Not every good job requires a college degree. But there’s no doubt that obtaining a degree can be a life-changer for someone aspiring to do more in their chosen field or deciding to pursue an entirely new career.

So, we will also increase our investment in the innovative “Some College, No Degree” program created by Higher Education Secretary Brian Bridges that is helping to smooth the transitions of adult learners who left college – even years ago – but are now going back to complete their degrees.

These are paths we hope we can get more New Jerseyans to travel. They are the paths to some of the most rewarding careers.

Right now, there is a nationwide shortage of new educators. We feel this ourselves. To pull more qualified folks into the profession, increase diversity, and begin closing our state’s educator shortage, this budget will support a total of $15 million in stipends for student-teachers and waiving of teacher-certification fees.

These are two initial recommendations from my Public School Staff Shortage Task Force, and I am proud to put them forward in this budget.

This budget will also allow us to meaningfully take on the mental health crisis, especially among our youth.

I have made youth mental health the focus of my Chair’s Initiative through the National Governors Association. And as I work with my colleagues and experts from across the nation in rising to this challenge, I also want to make New Jersey a model.

This budget will launch the New Jersey Statewide Student Support Services network to help countless more students focus on mental health wellness. And it will enhance our overall investment in the Department of Children and Families and the Children’s System of Care to more fully support the needs of our young people.

We’re also going to roll out statewide the Attorney General’s innovative and successful ARRIVE Together program.

Under ARRIVE Together, situations involving individuals facing a mental health crisis are responded to by a team – a plain-clothed local police officer or State Trooper, and a trained mental health professional.

A mental health professional like Cumberland County’s Elvira Smith. And it is Elvira, and the mental health professionals like her, who take the lead to de-escalate a situation to protect all involved.

Both our youth mental health initiatives and ARRIVE Together share a common core value – when we eliminate the stigma associated with mental health challenges, we save lives.

We’re also going to maintain our investment in the Cover All Kids program that ensures every child has access to vital health care coverage.

We’re going to expand access to the services our veterans need by seeing that every county has its own Veterans Services Office through the Department of Military and Veterans Affairs.

And through the First Lady’s initiative, we will continue to transform New Jersey’s maternal health landscape into the national gold standard – and we will not stop until every mother begins her parenthood journey, healthy and supported, and ready to begin one of the most important jobs anyone will ever have.

And protecting your health also means ensuring every family has clean water to drink, to cook with, and to clean with … so this budget will invest federal American Rescue Plan funds to continue upgrading and replacing our aging water infrastructure.

We’re on a multi-year path to securing clean water for every family. And this budget will keep us on that path.

This budget will also invest significant federal American Rescue Plan funds in preserving affordable housing and creating urban workforce housing to support the families and dreams of those who are living on the front lines of the reinvention of our cities.

Another barrier to affordability to many families is medical debt – a burden that has weighed heavily on the financial futures of countless New Jersey families. It has stopped many cold in their tracks, led others to consider bankruptcy as the only option, and prevented countless people from seeking critical medical care.

I propose a pilot program to eliminate the medical debts of potentially tens of thousands of New Jerseyans.

Literally, for pennies on the dollar, we can remove a crushing weight holding down many families to get them back on track. No one should go broke simply because they were ill.

These are all smart investments in our families and communities, but they are also vital ones for racial equity and for ensuring those historically left at the margins have their place in that Next New Jersey.

In this spirit, this budget will set up a new Urban Investment Fund to work alongside our current business incentive programs to support the arts and the creation of parks and gardens, among other urban infrastructure, to help our cities not just become more inviting for new residents, but for workers returning to downtown offices.

And we’re going to maintain our investment in our commuters by giving them a sixth straight year of no fare hikes on NJ TRANSIT. And, at the same time, we’re going to cut transfers from NJ TRANSIT’s capital program to its operating program to a 21-year low.

That means more money to keep the lines running.

The facts bear out that NJ TRANSIT is moving in the right direction. I stood here five years ago and said my administration would get NJ TRANSIT working again even if it killed me. Well, I’m still here.

And NJ TRANSIT is far better today than when Sheila and I took office.

We will create a brand-new $100 million Boardwalk Fund to partner with our Shore towns and counties — from the Wildwoods to Atlantic City, from Seaside Heights to Asbury Park – to ensure that the wooden main streets which are the backbones of their communities remain just that.

The Boardwalk Fund will match county and local investments, so our Shore communities can do more with their money while also taking more of the load off the shoulders of local property taxpayers.

And while we’re at it, we’re going to give all New Jerseyans a second-straight year of being able to enjoy our state parks – including Island Beach State Park – without having to pay an entrance fee.

This budget will also invest state and federal funds, along with our proceeds from the Regional Greenhouse Gas Initiative, to make critical investments that will make our state more sustainable and resilient to climate change, and move us toward securing our long-term clean energy goals.

It will support projects like starting the build-out of the Garden State Greenway, so future generations can benefit from what will be a true gem of our state’s parks system.

And one of those beneficiaries is with us today. Kennedy Fuller is an 8th grade student from Jersey City, and a Girl Scout Cadette with Troop 10910 from the “Heart of New Jersey Council.” She and her troop-mates went door-to-door to build support for building the Greenway. Let’s get this project going for her, and for them.

And this budget will support goals like getting ourselves to a 100 percent clean-energy economy by 2035 …

Investments like building out our statewide electric vehicle infrastructure …

Moving more of our housing and commercial building stock away from fossil fuels and toward energy-efficient heating and cooling technologies …

Helping local governments buy zero-emission trucks, and so much more.

We are going to create a new $40 million Green Fund to be administered by the Economic Development Authority, as well as pump $12 million more back into the Clean Energy Fund.

This is how we take on the challenge of climate change. This is how we build a more resilient and sustainable future. This is how we invest in the jobs of tomorrow.

And everything we are doing underscores the wisdom of our reentry into the Regional Greenhouse Gas Initiative. It bears repeating …

Leaving RGGI was a failure of leadership. It was a fiscal failure that cost us nearly $280 million.

We’ve only been back in RGGI for three full years. In this time, alone, we have pulled in more than $365 million. And we’re putting this money to work to build a more sustainable and resilient future for our kids and grandkids, and those who will follow.

All of these investments in making our state more affordable and resilient are also making us more competitive.

Competitive to not just keep families here but to attract new ones looking for a home where their dreams can take flight and where good-paying, family-supporting jobs are ready for the taking.

Securing that second part means making ourselves equally competitive for business.

This is why this budget will allow the temporary 2.5 percent Corporate Business Tax surcharge to expire.

We hear from the business community that allowing this surcharge to lapse will mean more money for them to create jobs, to invest in new and more efficient equipment, to lower costs to consumers, and to be able to stay here.

So, just as they’ve trusted us to keep our word in letting this temporary surcharge expire, I’m expecting them to keep theirs with this revenue.

But it is much more than this.

Ending this temporary surcharge is simply one way we compete for the world’s leading companies and make New Jersey the place where entrepreneurs will want to come to start new ones.

Another way we compete for jobs – another way we make New Jersey an unmatched destination for businesses and the workers they bring with them – is by leading with our values.

I have said it many times before. Strong and progressive values – our New Jersey values – resonate not just around kitchen tables, but around corporate board tables.

Across the country, states are racing to the bottom on everything from erasing a woman’s right to control her own body, to telling students what books they can and cannot read and educators what they can and cannot teach, to rolling back LGBTQIA+ rights, to undoing the most basic and commonsense responsibilities for owning and carrying guns, to pushing through anti-worker and anti-union laws, to undoing decades of progress on voting rights.

Not only are those policies against everything we believe in, they run counter to the beliefs of many companies that want to plant their flag where they can attract the top-tier talent they need.

That’s why this budget increases funding for public education, supports reproductive freedom, and fights climate change.

And it is why it is built to support a diverse state, that has among the lowest rates of gun violence, the strongest protections for the right to vote in the country, and respects the dignity of all people alongside other investments in our values.

From my first day in office I rejected the false choice that you are either for business or for hard-working families. We can be more competitive and more compassionate. A stronger economy builds a fairer New Jersey.

That’s how we retain and attract the businesses of the 21st century and beyond. By being strategic, by living our values, and by staying true to our word.

And while we’re working to pass this budget, let’s also commit to modernizing New Jersey’s antiquated liquor license laws.

This budget makes countless investments in our communities and Main Streets to secure their futures. And making a liquor license more affordable for more restaurants is a huge step to helping them secure their place in their community’s future.

After all, the majority of New Jersey’s restaurants aren’t chains and weren’t started by millionaire restaurateurs or celebrity chefs. They are family-owned small businesses.

And every single one creates jobs and supports the jobs of other small businesses by making their restaurants magnets that pull folks into downtowns.

Affordability. Community. Competitiveness. Fairness. Jobs.

Helping hardworking folks find their place in the Next New Jersey by securing their place in the New Jersey of today.

These values are what liquor license reform is ultimately about.

And it’s what this budget is ultimately about for every New Jerseyan.

I look forward to working with you over the coming 122 days to deliver a budget for New Jersey that continues to strengthen the foundation of the Next New Jersey.

And I am extremely pleased that, unlike the past five years, this time we’ll be in much closer proximity to each other.

After nearly six years, the renovation of the Executive State House is finally nearing its end. I hope to be here and working in my new office in just a couple weeks. I know that our work – whether it be on the budget or on any other issue – will be made easier when we can get together by walking across the hallway instead of driving down the street.

I must extend my gratitude to every member of the building trades who spent a total of nearly 1 million hours working to restore one of our most historic and iconic buildings, and the very symbol of democracy in New Jersey.

During the height of construction, nearly 250 union workers were on site on any given day.

The pride which they put into their work doesn’t just show. It shines. To each and every single one of them – and to the entire construction management team – I say, simply yet sincerely, “thank you.”

New Jersey’s state government has met here since 1792, making ours the second-oldest State House in continuous use in the nation.

It’s more than just where the Governor and the Legislature work.

U.S. Senators and Members of the House of Representatives, federal Cabinet secretaries and ambassadors, a Vice President, and a President have, at one point, each worked in this building.

Countless New Jersey luminaries have been celebrated and honored under our dome.

Abraham Lincoln spoke here.

The brass chandelier which illuminates this room was built and installed by Thomas Edison’s workshop in the earliest days of electric light.

What history this building has seen. And we can only imagine what history is yet to be made.

Across 230 years, this building has been expanded, gutted, expanded anew, gutted again, and restored.

The story of the State House mirrors the story of our state. Because, similarly, across the past 230 years New Jersey has grown, been knocked down, picked back up, dusted off, and restored.

But the rebirth of the State House mirrors the story of our past five-plus years of working together.

New Jersey’s cracks are no longer papered over, the leaks no longer plugged with duct tape, the faults no longer left for someone else to fix.

We did this together. And I thank you.

It took hard work to build this capitol. It took more hard work to rebuild it.

And that is a most New Jersey story.

We work hard. And, when you work hard, you should be able to provide a good life for you and your family, and set up a future where your kids can do better than you.

That is the American Dream.

And here is where we can rebuild that dream for every family in the Next New Jersey.

Yet, the question on so many minds is this: “Is my hard work going to pay off?”

And what I hear too often is: “I’m not sure it will.”

I understand that doubt. It was a question that tested my own mother and father.

Answering that challenge – decisively – is at the heart of this budget.

The answer is clear and emphatic: “Yes, your hard work will pay off.”

This budget and our administration are dedicated to it.

Everything in this budget – and everything we seek to do – is about growing and strengthening the middle class.

About providing more opportunity – and more affordability – for hardworking families.

And about building that Next New Jersey that uplifts each of us and works for all of us.

That is why this budget I present to the people of our state has more tax relief, more help for businesses to grow and create good-paying jobs, more investments to build a green economy and fight climate change, more affordable prescription-drug assistance for seniors, more child care for young families, more help to buy your first home and to stay in your current one, more commitment to making sure every child has access to health insurance, more public school funding and more help to bring new educators to New Jersey’s classrooms, more support for the kids who need it, and more attention to the bottom line to pay down our debts and secure the largest property tax relief program in our history.

So, in service to everyone who sent us here, let us join together as we shape this next budget and commit to this – the Next New Jersey is where opportunity grows, where rights are protected, and where we fight for each other, not with each other.

And most of all, let us continue making New Jersey the state where hard work pays off.

Thank you.

And may God always bless the great State of New Jersey and the United States of America.

To access more business news, visit NJB News Now.

Related Articles: