New Year Brings Fresh Start on Business Advocacy

At Issue

By Christine Buteas , NJBIA Chief Government Affairs Officer On Dec 31, 2019A new year brings a sense of optimism. That goes double for 2020 because it’s also the start of a new legislative session, when all legislative activities start over, and any bill that isn’t signed by the governor by January 21 at noon must be reintroduced. So with a fresh start, here’s what the state’s largest business Government Affairs team is working on in 2020.

Labor mandates. 2019 saw new mandates on paid sick leave, a $15 minimum wage, expanded paid family leave, and many more. NJBIA was at the forefront opposing these labor mandates and gained amendments that favored employers. Even so, businesses have a long list of new rules that have dramatically increased the records they need to keep and the fines and penalties they will have to pay for even minor infractions.

Christine Buteas,

NJBIA Chief Government Affairs Officer

Enough! Businesses have been hurt by these mandates. Our small businesses are absolutely reeling and desperately need a break. Unfortunately, NJBIA expects several mandate proposals to be at the forefront of legislative debate again. Among them is a requirement that would severely restrict employers’ ability to schedule employees’ work times. NJBIA will fight this mandate, as we have challenged the others.

Minimum wage. NJBIA led the fight against the $15-an-hour minimum wage bill last year, and while it was ultimately signed into law, we did get them to phase it in over five years instead of going right to $15 an hour immediately. But don’t think we’re done with the issue: NJBIA is going to continue to push for legislation to mitigate some of the negative effects of the law.

Perhaps none is more important than creating an economic off-ramp for future wage increases. Should New Jersey experience a recession or a disaster like Superstorm Sandy, increasing the minimum wage would be seen as a bad idea. But right now, those minimum wage increases would happen automatically no matter how bad the economy gets. NJBIA is urging the state to create a mechanism to suspend these automatic increases if economic conditions justify it. Many lawmakers see the wisdom of this, but the $15 minimum wage advocates are pushing back.

Taxes. NJBIA fought hard to ensure this year’s budget contained no broad-based tax increases. Despite Gov. Phil Murphy’s call for a higher income tax, legislative leaders stood firm. New Jersey already has the worst business tax climate of any state in the nation as well as the highest tax rates for personal income, sales and corporate income in our seven-state region. And, of course, New Jersey residents pay more in property taxes than those in any other state.

The governor is not backing down on his demand for even higher taxes, so NJBIA will be working with legislative leaders to achieve consecutive budgets without a broad-based tax hike.

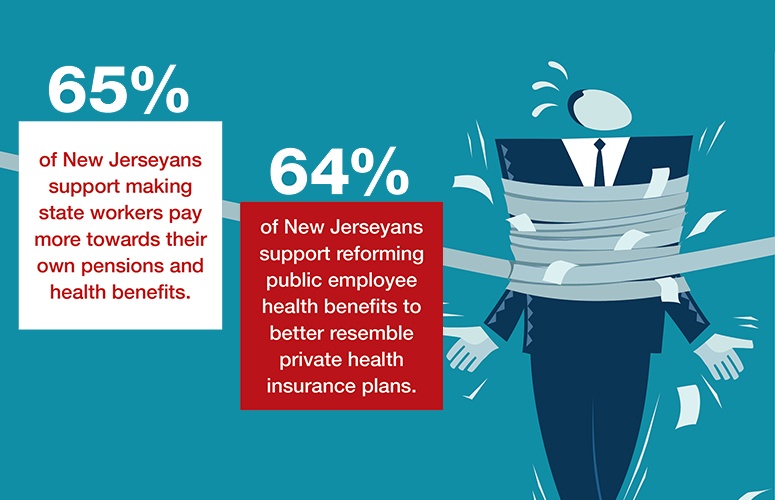

Fiscal reform. Senate President Stephen Sweeney is championing his Path to Progress fiscal reforms, many of which have been turned into legislation. NJBIA supports the Path to Progress and will be working with the Senate President to get many of these bills enacted. They include reducing the cost of public employee pensions and health benefits, regionalizing local government services and consolidating local government entities.

The state has long ignored its fiscal problems, and now, it has reached the point where it is at the edge of a fiscal cliff. As NJBIA research has shown, New Jersey’s debt obligation has ballooned by 382% in 10 years while its revenues increased only 23%.

Your Business. As always, Government Affairs relies on member companies to help us understand how legislative proposals will impact your operations. Please contact us at [email protected].

To access more business news, visit NJB News Now.

Related Articles: