State of the State Rebuttal Underscores a Tale of Two Parties

By Anthony Birritteri, Editor-in-Chief On Jan 11, 2023Updated on 1/12/2023

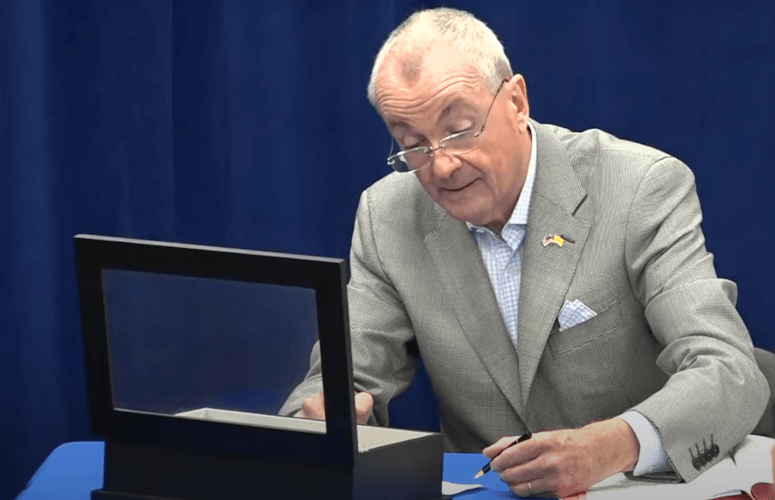

In his State of the State address yesterday, Gov. Phil Murphy said that New Jersey today is a stronger and fairer state that “is confidently moving in the right direction – forward.”

He touted many of his 2022 achievements and 2023 initiatives, including the ANCHOR property tax relief program, legal recreational cannabis, the growth of the state as a mecca for film and TV production as well as the offshore wind industry, and changing the state’s antiquated liquor laws.

Near the end of the speech, he stated: “… I can tell you very confidently – New Jersey is where opportunity lives, where education is valued, where justice is embraced, where compassion is the norm, and where the American Dream is alive and well.”

A few short moments after the speech concluded, even before hundreds of people vacated the fully crowded House Chamber, Republican legislative leaders were criticizing the speech, saying that despite the governor’s “rosy picture,” the state of the state is not good.

After five years of the Murphy administration and two decades of Democratic control in the Legislature, the outlook for New Jersey continues to get worse,” said Senate Republican Leader Steve Oroho. “We have the highest taxes, most debt and worst business climate in the nation. We have a state budget process that is out of control, with spending up nearly 50% since the governor took office.

“Democratic legislators continue to show no shame in tacking on billions in pork every year with no legitimate review or oversight process,” Oroho said. “At the same time, they are failing to effectively manage the cost of benefits for hundreds of thousands of public workers, which this year has resulted in huge healthcare cost increases for local governments that will lead to property tax spikes across the state.”

He also said that, over the last three years, “[Democrats have] squandered billions in CARES Act and American Rescue Plan relief funds instead of solving big problems with [this money].”

When asked specifically how these federal funds were squandered, Assembly Republican Leader John DiMaio said that the state’s Unemployment Insurance Trust Fund should have been made whole with this money.

According to Oroho, most states in the country used federal COVID relief money toward their respective UI Trust Funds, yet because New Jersey did not, businesses are looking at UI payroll tax increase of $1 billion over a three-year period, which started last July.

Regarding the 2.5% corporate business tax (CBT) surcharge on New Jersey’s top 9% CBT rate, Oroho said it should have already been eliminated, yet business now have to wait until Dec. 31 of this year for it to expire.

On January 12, Murphy announced on Bloomberg’s “Balance of Power” program that he would let the CBT surcharge expire at the end of the year.

DiMaio said a Republican plan calls for lowering the CBT from its current 11.5% to 2.5% over a four-year period, similar to what North Carolina has enacted.

“If you want to incentivize businesses in New Jersey, let’s cut the CBT. Doing so would create more jobs and people would stay here,” DiMaio said.

Both DiMaio and Oroho touted the Republicans’ $8 billion tax relief plan, which was introduced last year, as a way to make New Jersey more affordable.

“Our plan would have given $4 billion immediately back to millions of families, who would have received $1,500. Now they have to wait until May of this year to get a smaller portion of that,” Oroho said.

DiMaio said the Republican plan would roll back inflationary costs levied on income tax payers. “By indexing tax brackets for inflation back to the year 2000, we create a permanent and sustainable built-in system; a $1,600 a year income tax cut for families earning $110,000 per year. That is real money that would stay in their pockets, not like another rebate program [like ANCHOR] that would dwindle and fade away,” DiMaio said.

Overall, Oroho said that since Murphy took office, government spending has increased by more than $16 billion, and taxes have been raised 60 times. “That’s unacceptable,” he said.

To access more business news, visit NJB News Now.

Related Articles: