Prudential Introducing New Debt Management Offerings

On Feb 13, 2020Prudential is partnering with national nonprofit GreenPath Financial Wellness to introduce debt management advice and tools to its growing suite of workplace financial wellness solutions.

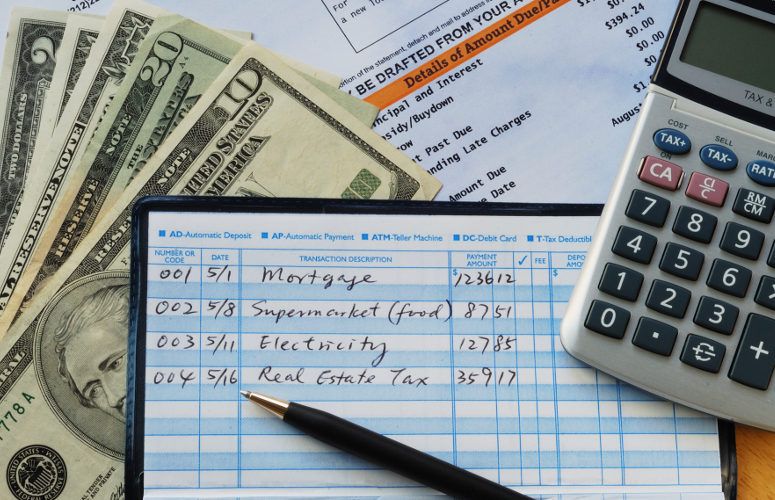

As household debt continues to reach new heights, rising to $14.15 trillion in the fourth quarter of 2019 from $13.54 trillion in the third quarter of 2018, Prudential is continually looking to offer solutions such as emergency savings and student loan assistance tools to workplace clients to help employees and association members manage their finances, the company says.

“It’s difficult to save for emergencies and invest in retirement when you feel crippled by debt. Debt also contributes to financial stress and negatively impacts workforce productivity,” said Vishal Jain, head of financial wellness strategy and development at Prudential Financial. “Helping individuals minimize the impact of debt is an important expansion of our financial wellness efforts, and we are excited to work with an organization like GreenPath which shares our passion for solving financial challenges.”

GreenPath offers a free session with a certified financial counselor to establish goals and explore debt repayment options. For a fee, employees or members who participate can also choose to enroll in a formal debt management plan designed to pay off outstanding balances in five years or less.

Nine organizations, including Prudential, have committed to the service, which continues to draw interest. It will be available to all institutional employers in the second half of 2020.

“Navigating debt and finances can be confusing and stressful. We are thrilled to partner with a like-minded leader in workplace financial wellness to reach more people with our proven tools to reduce debt and financial stress,” said Kristen Holt, president and CEO of GreenPath.

Prudential offers a broad suite of workplace financial wellness offerings, including solutions designed to help individuals plan for unexpected expenses and better manage debt. Its in-plan emergency savings tool uses after-tax contributions to build savings for unexpected expenses, creating a convenient way to save for both retirement and short-term needs, according to the company. Its student loan assistance platform, an online resource offered by Vault, allows employees to explore student loan consolidation and repayment options and provides a channel for employers to make repayment contributions.

To access more business news, visit NJB News Now.

Related Articles: