NJ Industrial Experiences Historic Stretch of Positive Net Absorption

On Oct 21, 2016New Jersey’s industrial market has experienced 14 consecutive quarters of positive net absorption – its longest stretch ever. Amazon.com, the e-commerce giant, signed the largest industrial lease in New Jersey during third quarter 2016 and a force behind a chain reaction that is responsible for a large majority of the demand for warehouse space in the Garden State, according to Transwestern’s Third-Quarter 2016 Industrial Market Report.

As many retailers take steps to join the e-commerce race – most notably, Wal-Mart, which acquired online retailer Jet.com during the third quarter – New Jersey continues to be considered by many as the premier location on the East Coast for industrial space.

“Logistics companies and other e-commerce-related tenants have been swarming to New Jersey, particularly the submarkets along the New Jersey Turnpike, to take advantage of our central location within the Northeast corridor and proximity to New York City and Philadelphia,” said Transwestern Managing Director Jeffrey Furey. “As a result, the state’s industrial market is seeing a tremendous influx of foreign capital. It’s become almost impossible to overbuild, as demand is at an all-time high. In fact, some developers have begun exploring contaminated sites that are well located.”

With market fundamentals expected to remain extremely strong, the State of New Jersey continues to invest millions in its ports in order to modernize an infrastructure that needs to be equipped to handle the larger container ships traveling through the recently widened Panama Canal. However, while investments have been made in the state’s roads and bridges, much of New Jersey still operates with 19th- and 20th-century infrastructure, which scores poorly according to the 2016 American Society of Civil Engineers report card.

“A significant portion of New Jersey’s transportation network still needs vast improvements,” said Transwestern’s New Jersey Research Director Matthew Dolly. “That should improve with the recent Transportation Trust Fund agreement, which calls for a gas tax increase of 23 cents per gallon for gasoline and 27 cents per gallon for diesel fuel. Since this could affect the inclination of consumers to shop online rather than drive for products, a great location becomes even more critical for companies.”

Market highlights from the Third-Quarter 2016 Industrial Market Report include:

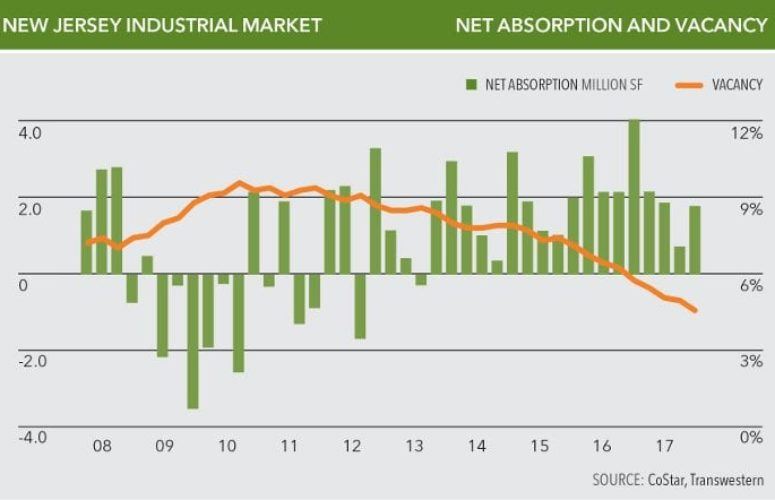

- Year-over-year net absorption reached 11.5 million square feet – its highest level since third quarter 2002 to 2003.

- The vacancy rate improved to 5.8 percent during the quarter – its lowest level since first quarter 2001.

- Rent growth, which reached a record high for the third straight quarter at $6.50 per square foot, shows no signs of slowing down.

- During the third quarter, the market experienced its highest year-over-year rent increase since 2000, at 12 percent.

- Quarterly rent increases were observed in 19 of the state’s 25 submarkets.