NJCPA Survey: Gubernatorial Winner Should Focus on Cutting Property Taxes

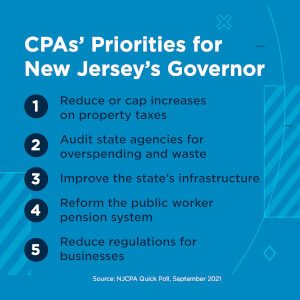

On Sep 23, 2021In a survey of more than 540 certified public accountants conducted earlier this month by the New Jersey Society of CPAs (NJCPA), reducing or capping increases on property taxes was named the highest priority for the winner of the New Jersey gubernatorial election in November. This was closely followed by auditing state agencies and programs for overspending, waste and revenue allocation and improving the state’s infrastructure. Rounding out the top five were eliminating the pension system for all new public sector workers and replacing it with a 401(k), and reducing regulations and red tape for businesses in the state.

In the NJCPA’s 2017 survey, reducing property taxes, improving the state’s infrastructure and converting public pensions to 401(k)s also ranked in the top-five gubernatorial priorities.

The 2022 fiscal year budget signed by Gov. Phil Murphy in June provided for an expansion of multiple tax relief programs, including those aimed at providing relief for seniors and middle-class families, such as the Middle-Class Tax Rebate, updating the Homestead Benefit and extending the veterans property tax deduction to peacetime veterans. Republican gubernatorial candidate Jack Ciattarelli, meanwhile, called for an to end to property tax increases caused by home improvements and a freeze on property taxes for all homeowners at age 65 regardless of income or length of residency.

To access more business news, visit NJB News Now.

Related Articles: