New Jersey’s Industrial Vacancy Rate Improves to New Record Low

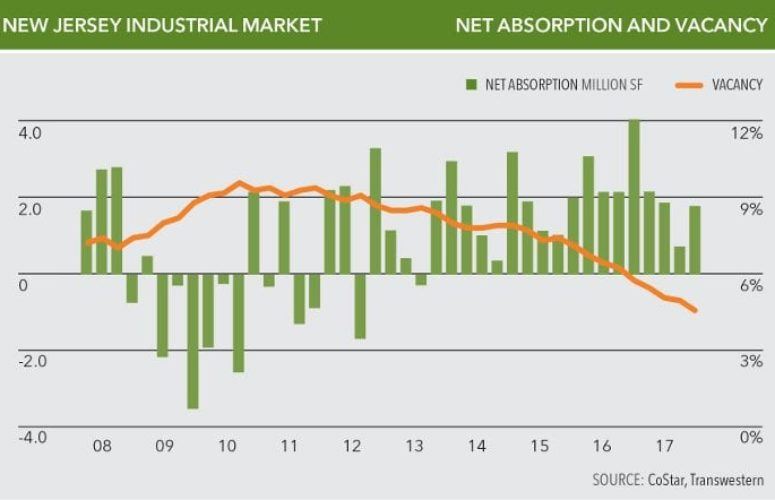

On Oct 27, 2017Despite a record amount of warehouse development in New Jersey in recent years, the state’s industrial vacancy rate continues to improve, reaching an all-time low during the third quarter, according to Transwestern’s Third-Quarter 2017 Industrial Market Report. The market’s current vacancy rate of 4.6 percent bests the previous low of 4.8 percent, which was recorded during second quarter 2000.

Although total inventory has grown by more than 10 percent, with 20 million square feet developed during the past five years alone, occupancy continues to tighten throughout the market. Today, there is 63 million more square feet of industrial space occupied in New Jersey than in second quarter 2000. Furthermore, while there is currently 14.3 million square feet of space under construction, more than half of what’s in the pipeline is preleased.

“As the market strives to keep up with the e-commerce boom and the corresponding increases in shipping traffic and job growth, demand for state-of-the-art warehouse space in New Jersey continues to outpace supply,” said Transwestern Managing Director Alex Previdi. “After evolving from a manufacturing state into a home to corporate headquarters and office campuses, New Jersey is once again going through a transformation, becoming one of the country’s most important warehouse and distribution markets.”

Each of the 25 New Jersey submarkets examined by Transwestern boast single-digit vacancy levels, with six submarkets registering rates of less than 3 percent. The New Jersey Turnpike Exit 8A submarket continues to spearhead activity, recording the strongest quarterly and year-over-year occupancy improvements. Other submarkets that registered strong levels of leasing activity during the past 12 months include Bergen North, Turnpike Exit 11/Perth Amboy, Exit 13/Linden, Exit 13/Elizabeth, and Somerset.

Steep increases in asking rents are coinciding with supply constraint. With an average of $7.48 per square foot during the third quarter, the market eclipsed its all-time high for the seventh consecutive quarter. Just one submarket has an average asking rent below $5 per square foot, which was the average rent for the entire market in 2000.

“The prosperity that has resulted from New Jersey’s warehouse boom was symbolically displayed during the third quarter, when the largest-capacity container ship ever to visit the Port of New York and New Jersey passed under the raised Bayonne Bridge,” said Transwestern’s New Jersey Research Director Matthew Dolly. “Because of the relentless demand, it seems there is no ceiling for asking rents, which have increased in 15 of the past 16 quarters, and are now, on average, 46 percent higher than the post-recession low.”

Other market highlights include:

- Six of 25 submarkets have average asking rents of $8 or higher.

- Over the past five years, rents have risen, on average, by over 40 percent. In many areas, rents have increased by well over 50 percent.

- During a 12-month period ending in July 2017, there was a 17 percent increase in the number of jobs for laborers and freight, stock and material movers. There was a six percent increase in heavy and tractor-trailer truck drivers.

- In August 2017, the Port of New York and New Jersey recorded its highest ever monthly level of container volumes, while the year-to-date total was up 6.7 percent from a year prior and ahead of 2015’s record-setting pace.