Murphy’s Budget Proposal: Approx. $1B in New Taxes

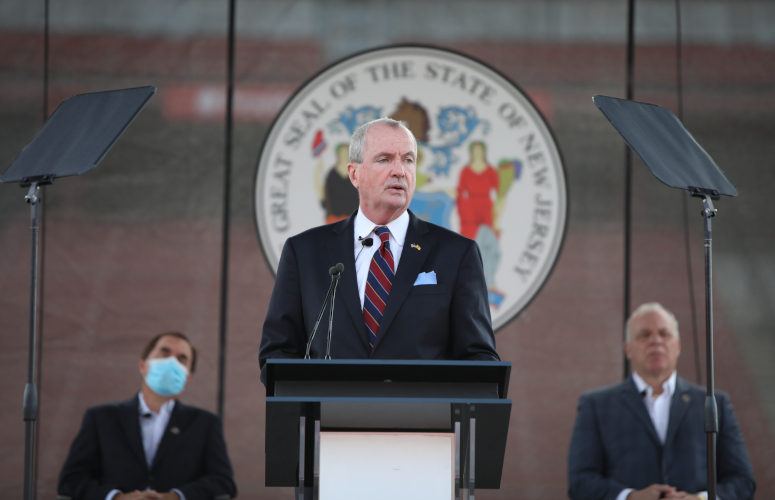

By George N. Saliba, Managing Editor On Aug 25, 2020Gov. Phil Murphy today unveiled a revised budget proposal calling for approximately $1 billion in new taxes, as he simultaneously proposed $4 billion in new borrowing and $1.25 billion in spending cuts, for a $32.4 billion total budget. Delayed because of the coronavirus pandemic, New Jersey’s FY2021 budget must now be finalized by October 1.

In proposing an expansion of the millionaires tax, Murphy cited “those who continued to prosper as this [coronavirus] pandemic raged around us,” and said that in order to strengthen middle-class families, “the wealthiest among us – millionaires and large corporations – need to pay their fair share in taxes, whether it be in income or in buying a yacht.”

Murphy additionally continued his call for “direct federal assistance” to states during the coronavirus pandemic, against the backdrop of the New Jersey State Supreme Court’s recent approval for New Jersey to potentially borrow up to $9.9 billion.

Of the proposed budget overall, New Jersey Business & Industry Association (NJBIA) President and CEO Michele Siekerka said, in part, in a statement, “New Jersey businesses have already sacrificed their revenues and livelihoods to prevent the spread of coronavirus by shutting down their operations. Business owners have tapped their own savings and taken on new debt to keep from going under completely, and to continue paying their employees what they can.”

She added, “New taxes on the very same businesses that have already given so much and are the only ones that can drive our future recovery is inconceivable considering that the state was just given $9.9 billion in borrowing authority. NJBIA calls on our Legislature to fix this irresponsible budget.” (read Siekerka’s full statement here).

Taxes

In a move aimed at generating $390 million, the aforementioned millionaires tax would involve increasing the marginal tax rate from 8.97% to 10.75% on all monies individuals earn over $1 million, while, separately, Murphy also proposed making the 2.5% Corporate Business Tax (CBT) surtax permanent, which would yield about $210 million.

Increasing the state’s cigarette tax to $4.35 per pack would generate about $143.1 million, the state said, while increasing the HMO Assessment to 5.0% would yield about $102.7 million for fiscal year 2021.

Among other taxes, the budget proposal calls for a “5% surcharge to individuals with federally Qualified Business Income (QBI) greater than $1 million who have benefited from a regressive new deduction for pass-through entities created under the 2017 federal Tax Cuts and Jobs Act.” This would add about $75 million to the state’s FY2021 coffers, according to the state.

Borrowing

And while Murphy’s revised budget proposal includes $1.25 billion in spending reductions and solutions across all executive state departments, it likewise proposes some $4 billion in borrowing to – as the state describes – “close a substantial budget gap and allow for a sufficient surplus to weather future health and economic uncertainties.”

The bonding would be permitted via the COVID-19 Emergency Borrowing Act which, again, allows New Jersey to bond up to $9.9 billion, and which recently withstood legal challenges.

Murphy told the audience today, “This budget envisions a closing surplus of more than $2.2 billion – a much-needed cushion against revenue shocks from a second [coronavirus] wave. This surplus is not a luxury. It is a product of lessons learned: Think ahead.”

State Senator Joe Pennacchio (R-26) said of the borrowing, “In what world do you borrow $4 billion to build a $2 billion surplus? This is about politics, plain and simple, and the governor setting himself up with the state credit card to play Santa Claus as he heads into his re-election campaign next year.”

Investments / Spending

The budget proposal also calls for spending in various areas ranging from “safe and modern drinking water infrastructure,” to assisting children with behavioral needs, as well as affordable housing development and $5 million for Early Voting in elections, to name few examples.

The proposed budget additionally introduces Baby Bonds – $1,000 deposits for New Jersey babies born in 2021 – into “families whose income is less than 500% of the Federal Poverty Level, or $131,000 for a family of four. When these residents turn 18, they can withdraw these funds to help them pursue higher education, buy a home, start a business, or pursue other wealth-generating activities.”

Meanwhile, the proposed budget includes monies for New Jersey to provide its own state health insurance subsidies to those residents with annual income up to 400% of the Federal Poverty Level via the New Jersey Health Insurer Assessment Act.

NJBIA

Of the budget overall, NJBIA’s Siekerka also said, “This budget simply does not reflect the stark reality of our times. Instead of keeping expenses low for our taxpayers, Governor Murphy is raising taxes to make New Jersey businesses less competitive. Instead of holding the line on spending, Governor Murphy has proposed spending $1.4 billion or $3.6% more than the prior year and $5.4 billion or 15.6% more than the budget three years ago before he took office.”

To access more business news, visit NJB News Now.

Related Articles: