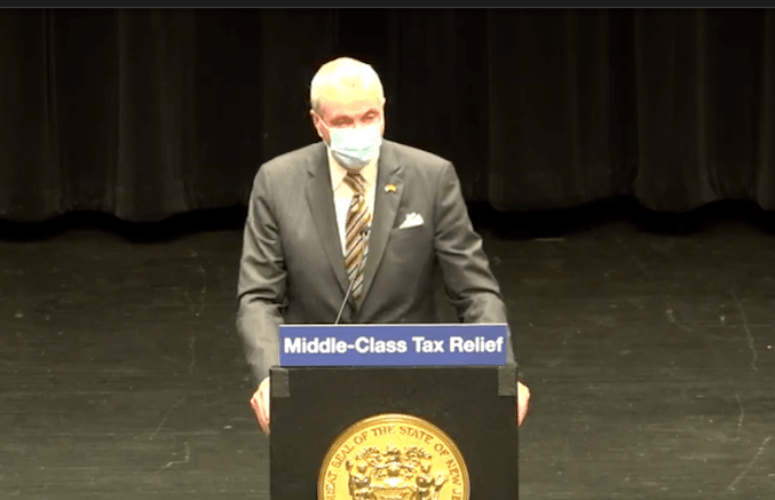

Murphy Signs FY2021 Budget, Millionaires Tax

By George N. Saliba, Managing Editor On Sep 29, 2020Gov. Phil Murphy signed New Jersey’s FY2021 budget today, which includes approximately $4.5 billion in new borrowing and affects the business community with a corporate business tax (CBT) increase as well as a highly publicized millionaires tax expansion. Today’s signing of the Fiscal Year 2021 Appropriations Act meets a deadline that had been extended from June 30 to Oct. 1 due the coronavirus pandemic.

While Murphy described the overall budget as “meaningful tax fairness,” the business community noted that an 11.5% CBT will make New Jersey the state with the highest CBT in the nation for the year 2021, and, separately, that the millionaires tax increase to 10.75% on income earned over $1 million may accelerate an ongoing trend of wealthy, tax-paying residents fleeing the state. The 10.75% rate had previously only applied to monies earned over $5 million; income of between $1 million and $5 million had previously been taxed at 8.97%.

The New Jersey Business & Industry Association (NJBIA) criticized the budget’s $4.5 billion in borrowing because, in part, state tax revenues are not as deficient as was anticipated, and, moreover, a significant portion of the budget’s new spending is not related to the coronavirus pandemic. The 1947 New Jersey State Constitution forbids borrowing without voter approval, but the New Jersey State Supreme Court allowed it this year, essentially because the coronavirus pandemic created an emergency exception.

Of today’s budget overall, NJBIA President and CEO Michele Siekerka said, “With $215 billion in debt, a crushing business climate, and a continued appetite to tax and spend, New Jersey simply cannot continue along this path.

“We are encouraged by talk of real reforms as we turn the page from this budget, but it can no longer be about talk, and actions must truly be meaningful. We look forward to working with our policymakers to make it happen.” (Read Siekerka’s full statement, here).

Additional Budget Details

Meanwhile, the new budget expands the minimum age of eligibility for the New Jersey Earned Income Tax Credit (NJEITC) from 25 years of age to 21, which is estimated to affect 60,000 residents, as it also raises the NJEITC to “40% of the federal credit, completing the third of three phased-in increases under a 2018 law signed by Governor Phil Murphy.”

Murphy said, in part, “The budget safeguards key programs that our families and residents are relying upon to see themselves through the pandemic, especially our most vulnerable residents, and it does not pull the rug out from under them. And, importantly, this budget lives up to the ideal of shared sacrifice in trying times by including meaningful tax fairness.”

Among a host of other reforms, a tax rebate of up to $500 for households with at least one dependent child and a married-couple with income of less than $150,000 ($75,000 for single households) is also part of the new budget.

To access more business news, visit NJB News Now.

Related Articles: