Murphy Signs Economic Recovery Act of 2020

By Anthony Birritteri, Editor-in-Chief On Jan 7, 2021The state has a new economic incentives program with the signing of the $14.4-billion New Jersey Economic Recovery Act of 2020.

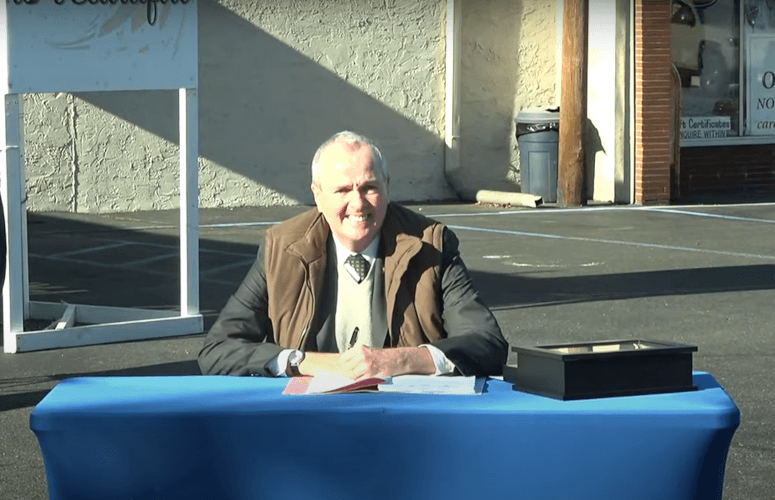

At a morning ceremony at Carella’s Chocolates & Gifts in Hamilton, Gov. Phil Murphy said, “We built this program on the twin pillars of transparency and fairness to fuel the creation of good paying, future-focused jobs and to ensure sensible spending caps and strong safeguards to protect taxpayers and communities.”

He said that the new program is not just tax incentives for large corporations: “That was the old way of thinking, but it doesn’t mean it will not apply to big corporations.”

Small business was the focus of Murphy’s comments today, as he explained, “Our future rides on the backs of our small businesses that employ the majority of our residents, especially those owned and operated by women, people of color, and veterans.”

He said the incentive package’s Main Street Recovery Program will provide a direct $50-million appropriation for grants, loans, loan guarantees, and technical assistance to small and micro businesses. Many business groups including NJBIA, however, said small businesses will need much more to help them sustain or recover from the pandemic.

For high-tech startups, Murphy said the program’s NJ Evergreen Fund, which pairs state resources with private venture capital investments, is a “game changer in our efforts to remake New Jersey into the global center for innovative new businesses working on the leading edge of the future economy.”

Other programs Murphy discussed included the state’s first historic preservation tax credit that will repurpose historic buildings. “This will create new jobs for our union trades and create new homes for businesses, while strengthening the core of various communities by honoring their pasts,” he said.

The Act also includes a food desert alleviation program, a brownfields remediation program, and a program to support anchor facilities such as hospitals, education and arts/cultural institutions.

All of the programs in the legislation have a combined incentives cap of $1.5 billion. Per-job credits and total credits per business are also capped. However, these are multi-year caps that allow flexibility through rollovers or borrowing. Additionally, there is a $2.5 billion set aside for large transformational projects, such as attracting a large corporation into the state.

According to Michele Siekerka, president and CEO of the New Jersey Business & Industry Association, “We believe this is a comprehensive and balanced plan that comes at a most opportune time, as we work to recover from the pandemic. We are encouraged by the flexibility, depth and richness of the programs, with an emphasis on high-growth industries, ample opportunity for transformational projects, and checkpoints to ensure projects are benefitting our great state.”

She added, “With an economic plan of such enormous scope, there are always areas that can be improved upon and we hope there will be further assistance for our challenged Main Street businesses. Going forward, NJBIA will continue to encourage revisits of the programs by our policymakers to ensure there is an appropriate balance of opportunity for businesses of all types and sizes in New Jersey.”

Senate President Stephen Sweeney stressed that the package is not a giveaway. “This has been talked about, by opponents, completely wrong. We were, for a long time, without an incentives program and that wasn’t helping us … but it did bring us to the table to make a better deal. When people start to read the legislation, they will find that we ensure opportunities throughout the state, for every county. It’s all been about fairness, equity and investment.”

According to Assembly Speaker Craig Coughlin, the legislation is “broad in scope and covers many potential areas for growth and development and job creation in New Jersey. It was important that we position ourselves to be ready for the inevitable recovery from the COVID pandemic.”

Aisha Glover, vice president of urban innovation at Audible, former head of the Newark Alliance, and board member of the New Jersey Economic Development Authority, said that on the compliance side, the legislation has important and commonsense protections that provide for greater accountability and oversight. “As an NJEDA board member, I commend the caps on the programs and the job creation awards that are limited to what is needed to actually incent projects. These are not just commonsense protections, but also good policy,” she said.

She hopes that the NJ Innovation Evergreen Find will invest more in minority and women-owned businesses. “As one of the most diverse states in the country, we should be intentional on how we leverage this opportunity to not only attract more venture capital to our state, but prioritize ventures utilizing MBEs or WBES, which is precisely what the Evergreen Fund does.”

To access more business news, visit NJB News Now.

Related Articles: