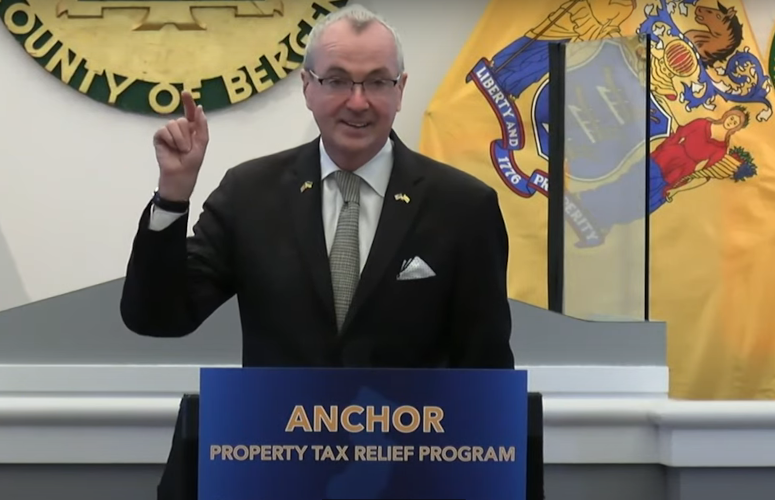

Murphy Proposes $900M ANCHOR Property Tax Relief Program

By Anthony Birritteri, Editor-in-Chief On Mar 3, 2022Nearly 1.15 million New Jersey homeowners and more than 600,000 renters may see property tax relief with the announcement by Gov. Phil Murphy today of the $900 million ANCHOR property tax relief program. ANCHOR, whose acronym stands for Affordable New Jersey Communities for Homeowners and Renters, will be part of the governor’s FY 2023 budget proposal, which he will deliver this coming Tuesday.

The announcement comes as the Murphy administration is expected to realize a $3 billion increase in tax revenues, 21% more than what was budgeted for in the current fiscal year.

With ANCHOR, which would replace the state’s Homestead Rebate program, residents earning up to $250,000 per year would receive an average rebate of $700 in fiscal year 2023. Renters making up to $100,000 per year would receive an average rebate of up to $250.

Funding for the program would increase over a three-year period. By 2025, ANCHOR would be funded at $1.5 billion annually with rebates rising to an average of $1,150 for homeowners.

Meanwhile, Senate Republicans are expected to introduce legislation that will deliver their own property tax relief plan. According to Senate Republican Leader Steven Oroho, this plan would “give New Jerseyans a $500 or $1,000 tax credit, depending on their filing status, when they file their 2021 New Jersey income tax return this spring. We’re proposing direct tax relief that would put real cash back into people’s wallets quickly.”

The Republican tax credit plan would be given to households with gross incomes of up to $500,000.

With the average state property tax being just under $10,000, Murphy’s $700 rebate would represent a 7% property tax reduction, according to the governor. He added that the current Homestead Rebated program, introduced by Gov. Brendan Byrne in 1977, has gone through changes over the years, with a decrease in the number of those eligible, a decrease in rebate amounts, and rebates turning into tax credits.

“The time has come to realize that continuing to write and rewrite the Homestead program renders its meaning meaningless to more and more families,” Murphy said.

“Over the next two years, we will continue to invest in ANCHOR so that it meets the level of relief promised back in 2007,” Murphy added, perhaps alluding to days of the Corzine administration, when Homestead Rebates averaged $1,000.

State Treasurer Elizabeth Maher Muoio added that the ANCHOR program more than triples the number of residents receiving property tax relief compared to the Homestead program.

Lt. Gov. Sheila Oliver commented that the ANCHOR program would greatly help the state’s senior citizens living on fixed incomes. She stressed that after Gov. Murphy’s term is over, the Legislature and the next governor must keep the trajectory of the program moving forward.

According to Murphy, “Homestead has had a good run, but now it’s time for greater, more permanent relief. … It’s time we allow more families to ‘drop anchor’ and stay in their homes and the communities they love.”

To access more business news, visit NJB News Now.

Related Articles: