Murphy Enhances Proposed ANCHOR Property Tax Relief Program

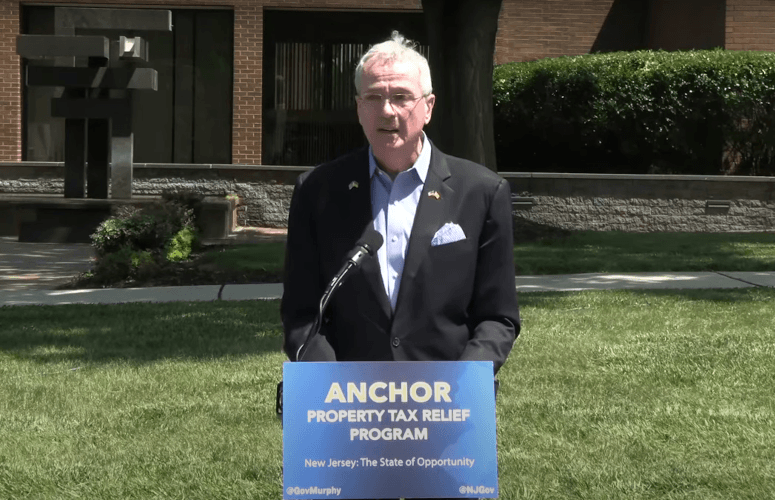

By Anthony Birritteri, Editor-in-Chief On Jun 15, 2022With the state experiencing a revenue surplus surge, Gov. Phil Murphy today announced an increase in the amount of property tax relief money to be distributed to homeowners and renters under the proposed ANCHOR program from a total of $900 million to $2 billion.

Under the ANCHOR program, which is part of the governor’s FY23 budget proposal, 870,000 households with incomes under $150,000 would receive $1,500 in direct property tax relief. Households with incomes between $150,000 and $250,000 would receive $1,000. More than 900,000 renters with incomes of up to $150,000 would receive $450. In total, the program would benefit more than 2 million households, according to the governor.

Businesses are excluded from the ANCHOR property tax relief program, as New Jersey Business & Industry President Michele Siekerka pointed out after the governor’s announcement.

The proposed expansion of the Anchor program to include more homeowners and renters is a significant jump from what was announced in March when the ANCHOR program, which stands for Affordable New Jersey Communities for Homeowners and Renters, was introduced. Under the first iteration of the program, 1.15 million households with incomes of up to $250,000 per year would have received an average rebate of $700. Renters making up to $100,000 per year would have received an average rebate of up to $250. The number of renters also jumps from 600,000 to 900,000 under the revised program.

The average New Jersey property tax bill was approximately $9,300 in 2021. According to Murphy, ANCHOR’s direct property tax relief rebates could offset more than 16% of the average property tax bill for some homeowners. “For a middle-class family receiving the $1,500 in direct relief, the average bill will effectively become $7,800; a property tax level New Jersey has not seen since 2012,” Murphy said today at a press conference in South Brunswick.

He said his focus is on making ANCHOR a lasting program that will deliver real relief to middle class and working families, not only this year, “but next year and years beyond.”

Senate President Nick Scutari commented that it is important to ensure that the ANCHOR program is sustainable and that any additional tax cuts and investments continue beyond the fiscal year.

“New Jerseyans need tax relief now,” Assembly Speaker Craig Coughlin added. ”It is my priority to enact the largest tax relief program in our state’s history and I am pleased that the $2 billion ANCHOR program puts us on course to deliver the boldest and most robust affordability agenda for our working and middle-class families for years to come.”

Meanwhile, Republican Senator Michael Testa said today that the new ANCHOR proposal is underwhelming compared to the Republicans’ “Give it Back” rebate proposal, which would deliver $4.5 billion in relief to 4 million New Jerseyans in rebates of $1,000.

“The ‘Give It Back’ rebates proposed by Senate Republicans would provide double the relief and help twice as many people. [The ANCHOR program] is likely a sign that Democrats are more focused on divvying up billions of pork in the budget than providing New Jersey families with real tax relief this year,” Testa said.

To access more business news, visit NJB News Now.

Related Articles: