Industrial Market Hits Record-Setting Trifecta

Third Quarter Blazes to Historic Levels in Absorption, Vacancy and Asking Rents

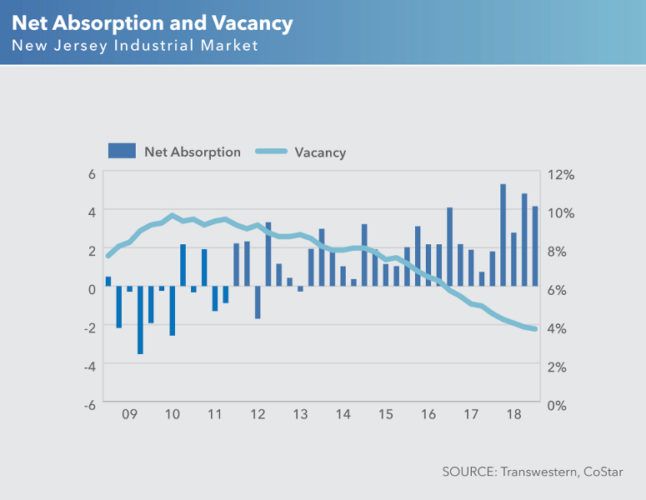

On Oct 30, 2018In a remarkable demonstration of strength and momentum, New Jersey’s industrial sector set new records last quarter in absorption, vacancy rates and asking rents, according to Transwestern’s Third-Quarter 2018 Industrial Market Report. Industrial real estate in the Garden State absorbed 17.1 million square feet of space during the past 12 months, surpassing its previous year-over-year high of 14 million square feet set the prior quarter. The rush to fill space was geographically widespread, with positive absorption seen in 21 of 25 submarkets on a year-over-year basis.

The Exit 8A submarket continued to dominate, experiencing 4.5 million square feet in absorption over the past 12 months and accounting for more than 26 percent of the market during that period. The Route 287 West and Meadowlands submarkets ranked second and third, respectively. Five submarkets accumulated more than 1 million square feet of positive absorption measured year over year.

“With industrial space filling up so rapidly, tenants are starting to evaluate their needs for industrial space earlier,” said Lori Zuck, managing director at Transwestern. “Industrial tenants are realizing they need more time to scour the market for opportunities and may also have to fund their own improvements as landlords become less generous with concessions.”

Transwestern reports that industrial vacancy has reached an all-time low of 3.8 percent. Vacancy, marking a record low for the fifth straight quarter, has now decreased steadily over 13 consecutive quarters. The level measured less than 3 percent in nine of 25 submarkets, despite delivery of nearly 10 million square feet of new industrial product so far this year. Even though the Route 287 West submarket played host to more than 2 million square feet in new construction, the area’s vacancy rate declined to its lowest level for a second consecutive quarter.

New Jersey’s industrial sector made history when average asking rents surpassed the $8.00 threshold for the first time ever, checking in at $8.04 per square foot. Rents in the industrial market saw their 13th consecutive quarterly increase, with five submarkets averaging levels exceeding $9.00 per square feet. Rents rose in 20 of 25 submarkets on a year-over-year basis, measuring 7.4 percent higher year over year and 50 percent higher than five years ago.

“As e-commerce steers the overall industrial market in a more mainstream direction, we’re seeing manufacturing and retail benefit from growing consumer confidence,” said Matthew Dolly, research director in Transwestern’s New Jersey office. “Increasing numbers of consumers are feeling optimistic about business conditions, at least on a short-term basis. We expect further firming in the manufacturing sector, and, although there is a shortage of labor, wage growth within the industry seems likely, perhaps making for a more enticing career choice for younger workers.”

Noteworthy leases last quarter in the manufacturing and retail worlds were signed by luxury consignment leader The RealReal, office supplier W.B. Mason, discount retailer Rugs USA and appliance manufacturer De’Longhi.

To access more business news, visit NJB News Now.

Related Articles: