Millionaires Tax, Rebates Part of New FY2021 Budget Deal

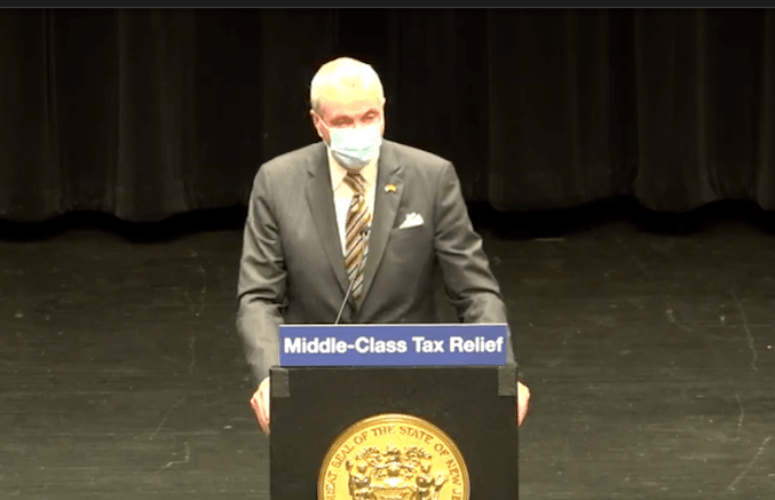

By George N. Saliba, Managing Editor On Sep 17, 2020An agreement has been reached to increase the state’s gross income tax rate on income over $1 million from 8.97% to 10.75% and, separately, to offer a tax rebate of up to $500 for households with at least one dependent child and a married-couple income of less than $150,000 ($75,000 for single households), Gov. Phil Murphy and other state leaders announced today. The deal is part of FY2021 state budget negotiations which leaders said are expected to meet an Oct. 1 deadline.

Murphy said the tax rebate would impact some 800,000 New Jerseyans, adding that the state would also change the definition of “dependent” in the state tax code “to match that of the federal tax code, so that there can be no more confusion and no more difference as to what that word means.”

Millionaires Tax

While Murphy said the millionaires tax will generate revenue for such needs as schools, communities and property taxpayers, the New Jersey Business & Industry Association (NJBIA) criticized today’s agreement by pointing out that the proposed FY2021 budget already includes billions of dollars in borrowing and that the tax is “completely unnecessary.”

The proposed FY2021 budget includes $4 billion in borrowing with an approximate $2.2 billion surplus, according to data which had been released by the governor’s office.

Michele Siekerka, NJBIA’s president and CEO, said today, “We note that the relief tied to this [millionaires] tax increase is undermined by other non-budget hikes for tolls and gas and other proposed taxes in the budget. Our taxpayers need real tax reform that includes property tax relief, while this does not really improve our overall affordability crisis or remove us from the edge of our fiscal cliff.” (Read Siekerka’s full statement, here).

Meanwhile, Murphy said of the millionaires tax, “As I noted in my budget address just three weeks ago, we do not hold any grudge, at all, against those who have been successful in life. But, in this unprecedented time, when so many middle-class families and others have sacrificed so much, now is the time to ensure that the wealthiest among us are also called to sacrifice.”

However, Siekerka – who has long noted the massive outmigration of wealthy taxpaying residents from New Jersey – said, “[The millionaires tax] incentivizes those who can live anywhere and work remotely, to leave New Jersey.”

Senate Republican Budget Officer Steven Oroho (R-24) said today, in part, “Year after year, IRS data shows that New Jersey continues to lose significantly more taxable income from high wage earners leaving the state than it gains from those who are moving in from elsewhere. The Democrats’ tax deal will accelerate that trend, make our State’s finances more unstable, and ultimately drive taxes higher for everyone. While the tax deal may seem like good progressive politics for Democrats with their elections on the horizon, it’s a bad economic move that will only dig the Garden State into a deeper financial hole over the long run.”

Corporate Business Tax

Siekerka also took aim at the proposed FY2021 budget’s corporate business tax (CBT) increase, which would make a 2.5% surtax permanent, creating an 11.5% CBT. She explained, “Governor Murphy’s budget also calls for a corporate business tax (CBT) increase that would give New Jersey the highest CBT rate in the nation in 2021. Perhaps our policymakers honestly believe that our state can simultaneously be an extreme outlier in both CBT and top income tax rates and expect to attract top talent and businesses from around the country. We wholeheartedly disagree.”

Public Health Metrics

Murphy meanwhile reported 617 new coronavirus cases today, an increased figure which has not been seen in New Jersey for about a month. The statewide coronavirus rate of transmission stands at 1.07%, meaning that each COVID-19 case is now leading to at least one other person being infected.

There are 431 COVID-19 patients in New Jersey hospitals, down from a peak of more than 8,000 patients in April.

To access more business news, visit NJB News Now.

Related Articles: