1Huddle First NJ Innovation Evergreen Fund Investment

On Oct 13, 2023The New Jersey Economic Development Authority (NJEDA) has approved the first investment in an emerging New Jersey company from the New Jersey Innovation Evergreen Fund (NJIEF). The investment into Newark-based 1Huddle, Inc. is the result of approval of an application submitted by EMERGING Fund Management LLC for an initial Qualified Investment amount of up to $500,000.

“The NJIEF is unique to New Jersey because of its self-sustaining model, designed to create a continuous loop of investment and mentorship,” said New Jersey Governor Phil Murphy. “The achievement of this first cycle of investment is something to celebrate, as it validates the program’s ability to fuel the next generation of innovative New Jersey businesses.”

the NJIEF, the State acts as an equity investor in startups, deploying up to $600 million into companies alongside professional venture capital groups. The Evergreen Fund currently has $46 million available and is expected to use this to fund initial investments into six to ten high-growth businesses in New Jersey. The NJEDA expects to conduct another tax credit auction in 2024 to raise additional capital for further investment.

“Today’s inaugural approval is a milestone moment for the program and for the state’s innovation economy,” said NJEDA Chief Executive Officer Tim Sullivan.

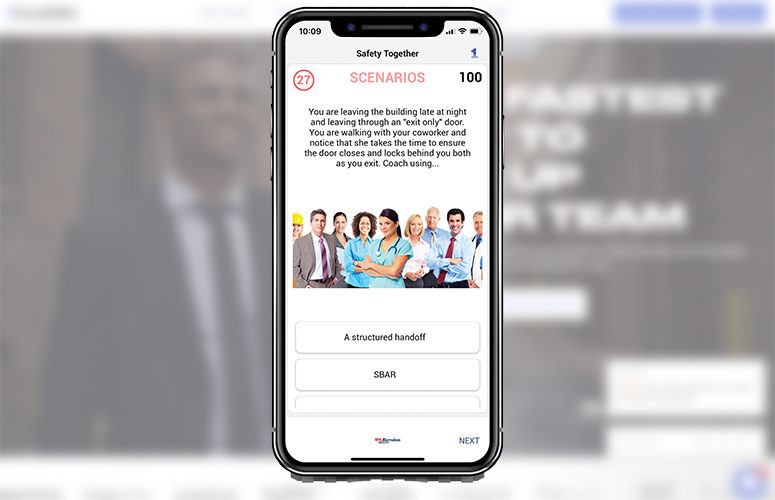

1Huddle is a future of work platform that uses quick-burst mobile games to more effectively onboard, upskill and fire up workers. The company previously received support from the New Jersey Commission on Science, Innovation and Technology’s Small Business Innovation Research Matching Grant Program. 1Hudlle has also received previous funding from New Jersey-based Newark Venture Partners. As part of this financing round by Emerging Fund Management more fresh capital comes into the state to alongside Newark Venture partners. The gaming company is an excellent example of capitalizing on the support available to emerging innovation businesses in New Jersey.

“We are honored and excited to receive the first investment from the New Jersey Innovation Evergreen Fund. The program is proof of the State’s commitment to fostering innovation and supporting startups making a real impact,” said 1Huddle Founder and CEO Sam Caucci. “This investment will allow 1Huddle to continue to accelerate our growth path – strengthening our workforce, advancing our technology, and uplifting workers across the globe. And, we’re proud to do it all here in New Jersey.”

EMERGING Fund is one of 10 Qualified Venture Firms (QVF) approved to date to access up to $12.5 million annually per investor from the NJIEF to co-invest in innovative, high-growth New Jersey-based businesses. It is one of the first growth equity funds to focus on the intersection between technology and the restaurant space (“ResTech”) and restaurant and entertainment concepts. Emerging Fund provides capital, strategic support, and industry expertise to innovative companies within the sector.

“We are excited to see 1Huddle as the first NJEDA-approved investment,” said Mathew Focht, general partner, EMERGING Fund. “This investment will support EMERGING and 1Huddle, as we deliver solutions on improving effectiveness in restaurant workforce training and empowering the hospitality worker.”

“Approval of EMERGING Fund’s investment in 1Huddle affirms that the NJIEF is doing what it was designed to do – create a sustainable cycle of investment that capitalizes on the strengths of mature, successful New Jersey companies to cultivate the next crop of groundbreaking innovations and industry-leading companies,” said NJEDA Chief Economic Transformation Officer Kathleen Coviello. “The NJIEF is helping us to achieve that vision and we look forward to seeing many more up and coming New Jersey businesses benefit.”

Applications for venture firms seeking to qualify as a QVF can be found here and are being accepted on a rolling basis. The ten firms approved to date represent diversity in terms of investment strategy, industry, and stage. Additionally, there continues to be strong momentum from interested managers. The roster of the current approved ten managers can be found here.

Applications for approved QVFs to apply for Qualified Investments into high-growth, innovative businesses based in New Jersey are also now open. The total unallocated capital available for new investments stands at over $46 million.

To access more business news, visit NJB News Now.

Related Articles: