Retirement Plan Combinations

Business owners can be flexible in finding the right retirement solutions for employees.

By Elaine Fazzari On Jul 31, 2017As a business owner, you have spent considerable time building your company into the well-oiled machine it is today. Now it’s time to consider putting a retirement plan in place for you and your employees. But which plan is a proper fit? Can your business utilize more than one retirement plan? According to present federal tax laws, the answer is, “Yes.”

Defined benefit plans accumulate assets to provide participants with certain benefits after specified events occur. The benefit, typically in the form of an annuity, is often based upon the participant’s age, years of service, and salary. Defined benefit plans offer higher contribution levels than other qualified plans, but are more expensive to establish and maintain because they require actuarial services to determine annual plan contributions and are subject to minimum funding requirements. The employer promises to pay a specific benefit in the future, and therefore assumes the risk of valuation changes in plan investments.

Defined contribution plans do not promise a specified dollar amount at retirement. The employees, employer, or both may contribute to the participants’ individual account within the plan. Contributions are usually based upon a percentage of the employees’ earnings. The participant’s account consists of their contributions, employer contributions, or both, and investment returns. The funds an employee has at retirement depend on the performance of investments over time. Therefore, the risk of fluctuations in return on investments is borne by the employee.

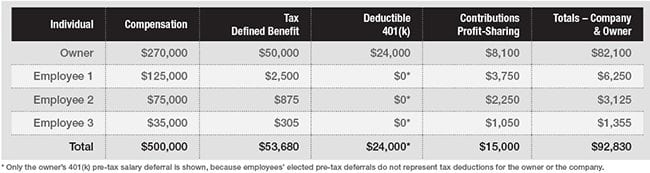

As a business owner, you have alternative plan combinations available to use as both a retirement and tax planning tool. One common combination is where a 401(k) plan is paired with a defined benefit plan. Let’s assume a business owner, over age 50, has three younger employees. Her company has a 401(k)/profit-sharing plan and a defined benefit plan. The table below is an example of the amounts that may be contributed and deducted in 2017.

The example illustrates how a company may take advantage of significant tax savings while adding substantially to the owner and employees retirement funds.

There are many types of defined benefit and defined contribution plans, which all have unique characteristics. All provide tax relief (either for business owners, employees or both) and the ability to take advantage of tax-deferred investment earnings to potentially increase growth of retirement savings.

About the Author: Elaine Fazzari, CPA, is partner-in-charge of audit, accounting and benefit plans at Raich Ende Malter & Co. LLP, Florham Park. She can be reached at 973-267-4200 Ext. 5124. E-mail: [email protected]

Related Articles: