Southern New Jersey Shines

Amid Atlantic City’s challenges, eight-county region moves forward with major economic development initiatives.

By Anthony Birritteri, Editor-in-Chief On Feb 3, 2017Is Southern New Jersey the last region in the state where businesses can find available land at affordable prices? Many economic development experts in the eight-county area say it is. And in the wake of negative news surrounding Atlantic City casino closings in recent years, major public- and private-sector developments are occurring throughout the region that will create new jobs in major growth industry sectors.

Marlene Asselta, president of the Southern New Jersey Development Council (SNJDC), says the region’s key attributes in attracting businesses include: large amounts of open space that are smartly developed thanks to the efforts of all county administrators; low property taxes when compared to central and northern New Jersey; a highly educated labor force, thanks to universities, colleges, community colleges and vocational/technical schools; and a transportation network that should be further improved with the hopeful expansion of the River Line light rail system. The 34-mile-long line, which runs from Trenton to Camden, should be extended to Glassboro and further south into Cumberland County. According to Asselta, all of the environmental impact studies are done, but a source of funding is still needed for the project. She hopes that money will come from the recent Transportation Trust Fund (TTF) renewal.

The TTF renewal was the No. 1 item on Asselta’s wish list for Southern New Jersey. Another item on her wish list that was granted this past Election Day was the majority “no” vote on the referendum that would have allowed casino gaming outside of Atlantic City. “We won that argument,” Asselta says. “However, we are not walking away and saying ‘hurray’ because we know the issue can be revisited any time. Our eyes are open to that, but we truly believe that gaming belongs within the boundaries of Atlantic City.”

With its vast problems, including: four casino closings in 2014 and the Taj Mahal closing last fall (for a total loss of just under 11,000 jobs); a 70 percent tax base drop due to the casino closings; and a municipal debt of $600 million, Atlantic City is still trying to reinvent itself in the face of its many challenges.

The goal is for more: family oriented tourism attractions besides gaming; sports attractions; and the attraction of new business sectors, including healthcare and high-technology firms; and more higher education initiatives. Finally, it is the goal of the state to put the city back on firm financial footing via its takeover.

Asselta hopes that the state’s takeover of the city’s finances will be short-term. “Based on the level of cooperation we have already seen from the state reaching out to Atlantic City’s government, I think [the takeover] will have a short life.”

Jim Wood, president and CEO of Meet AC – an organization which promotes the city’s meeting and convention industry, hopes the takeover will stabilize the city over the next five years. “It is what Atlantic City needed. The stability will provide relief to prospective meeting planners and help us generate more business,” he says.

Oliver Cooke, a Stockton University economics professor who also helps publish the bi-annual South Jersey Economic Review, views the state’s history of municipal takeovers as “mixed at best.”

“The short-term benefit is that [the takeover] provides Atlantic City a bit of breathing space as debt is restructured … most of the rating agencies see this as a positive credit story. It relieves the immediate short-term pressures the city faces. Whether or not it works to benefit residents in the long term is a different question.”

Wood says that demand for meetings and conventions is strong despite the closing of the five casinos. “We have seen demand increase to the point where we now have more business on the books and more tentative leads than we have ever had in Meet AC’s history.

Some of the bigger meetings and conventions this past year included The New Jersey League of Municipalities conference which attracted some 22,000 delegates and exhibitors (who were expected to spend an estimated $13 million during their stay). Meeting Professionals International (MPI) selected Atlantic City for its 2016 World Education Congress (WEC). Held from June 11-14 at Harrah’s Atlantic City Waterfront Conference Center, more than 2,000 people, including corporate, third-party, and association planners, suppliers, students, industry faculty and more, attended the event. The TEAMS Conference & Expo, the world’s leading conference and expo for the sports event industry, was also held in Atlantic City. The event attracted more than 1,400 attendees, including CEOs, executive directors and event managers from sports organizations as well as representatives from sports commissions and convention bureaus, corporate sponsors, event suppliers and other hospitality industry opinion leaders.

“These and other events help put us on the national stage, letting people know that Atlantic City is open for business,” Wood says.

Even the Southern New Jersey Development Council has moved its annual Sound Off for South Jersey conference to Atlantic City. The two day event will be held from March 2-3 at the Resorts Casino Hotel. The Sound Off, which addresses upcoming issues vital to the current New Jersey legislative session, will feature panels of federal, state and local officials. It routinely draws over 300 attendees.

Overall, Meet AC booked a total of 260 meetings and conventions in 2016 (events that were held in the year and that will be held in upcoming years), representing 289,422 future hotel room nights for Atlantic City.

Pending Atlantic City developments Wood looks forward to include the $210-million Atlantic City Gateway Project, which will include a new Stockton University campus (including a 56,000-square-foot academic building) and 72,000 square feet of corporate offices for South Jersey Industries (SJI), all in the city’s Chelsea section.

Some 1,800 Stockton students will use the academic building per day, while 500 students will live on site. SJI is expected to have 200 employees working at its new location. The entire project, being led by ACDEVCO, is expected to be completed by August 2018. It will also include some 21,500 square feet of retail space.

Wood is also excited about the rebirth of the shuttered 6.3-million-square-foot Revel Casino, which has been rebranded with the new name of “TEN.” Owned by Florida real estate developer Glenn Straub, the facility is expected to open sometime this year.

Max Slusher, director of the Atlantic County Improvement Authority and acting director of the Atlantic County Economic Alliance (ACEA), is passionate about attracting IT companies to Atlantic City and the rest of the county. He touts the ability of high-tech firms to have offices overlooking the Atlantic Ocean: “This is Malibu East … our water gets even warmer than the water temperature in Malibu,” he laughs.

The projects he mentions in this arena include the opening in October 2015 of a call center by Atlantic City Contact Center, LLC (a NETCAST BPO Services company) at the Claridge Hotel. The company, which is receiving a $3.27-million-per-year Grow NJ tax credit for 10 years, was expected to hire a total of 330 customer-service agents by the end of last year. Based on current and anticipated future demand for its call center services, the total number of jobs created at the center could climb to 1,000 by 2018.

“I currently have inquiries from two other call centers we are working with: one for Atlantic City and one for the mainland,” Slusher explains. “Recently, we received a phone call from a company interested in putting in a data center in the greater Atlantic City area. There is also a programming firm from New York City exploring the area. We’ve also been talking to senior vice presidents from tech firms in Philadelphia and other parts of Pennsylvania. Many executives have summer homes here, so it’s a lot easier to sell to them because they know the area.”

While Atlantic City gets all of the headlines (whether it’s good or bad news), the city is just 10 square miles – with only 3 square miles left that are developable – of the 563-square-mile Atlantic County region. “Atlantic City is extremely important to the county, but we need to look at the entire county holistically when we look at economic development,” Slusher says.

This is the mission and focus of ACEA, a private-sector, non-profit economic development corporation that was established in late 2015. With an unemployment rate in the high single digits (the rate fluctuates greatly because of the seasonal tourism economy) and one of the highest foreclosure rates in the US, Slusher says “the area is in trouble and we are using our ability and resources to turn the economy around.”

While the staff of the ACEA is still growing, its board of directors currently consists of private- and public-sector leaders in Southern New Jersey. Some include: Leo Schoffer, Leo Schoffer Enterprises, Interim Chairman; Steve Clark, senior vice president/chief financial officer South Jersey Industries/Gas; Rick Dovey, president, Atlantic County Utilities Authority; Dr. Harvey Kesselman, president, Stockton University; Dennis Levinson, Atlantic County Executive (Ex-Officio); Brett Matik, president, Harrison Beverage; Dr. Peter Mora, president, Atlantic Cape Community College; Christopher J. Paladino, president, ACDEVCO; Joe Sheairs, executive director, Stockton Aviation Research and Technology Park; and Mitch Zitomer, chairman, Greater Atlantic City Chamber.

The ACEA is concentrating on five industries it wants to grow, the result of an economic strategy plan for the county. They include: aviation and avionics (tied to the FAA Tech Center and Atlantic City International Airport); the life sciences (which would include healthcare, marine and environmental sciences); advanced manufacturing; entrepreneurialism; and tourism. “Of course, we are open to anyone with aspirations of relocating or developing a business in the county,” Slusher says.

Major business news developments he mentions include Comar, a plastic manufacturing company in Buena Vista Township, that is expanding its operations in a multi-million-dollar improvement that will add 100+ high-paying jobs to its existing 350. In nearby Buena, Teligent, Inc., a developer and manufacturer of injectable and topical prescription medicines, is undergoing a $50-million expansion of its facilities and will be adding 100 jobs to its existing base of 100 positions. The county is helping the company with workforce training initiatives as an incentive to stay.

The Atlantic County Improvement Authority has committed $25 million to build a new research park on the FAA Tech Center campus. In 17 months, a new building will offer 75,000 square feet of lab and tech space that will be leased to private companies. “We are probably looking at about 2,000 engineering and high-tech jobs with six figure salaries. It will have a major impact on the center of our county,” Slusher says.

Atlantic County’s major challenge, according to Slusher, is workforce development, which is tied into the need for greater access to higher education. “From my calculations, we can put another 20,000 university seats in the county and Southern New Jersey would still be underrepresented as far as access to higher education. … There is a strong correlation between enhancing the education levels and helping improve the economy.”

The Region

Discussing other South Jersey counties and burgeoning industries, Stockton’s Cooke reports that job growth in Gloucester County increased 7 percent between 2012 and 2016, with the growth tied to sectors such as education, healthcare, retail trade and transportation (the latter two sectors are the two largest job generators).

Meanwhile, Ocean County’s job base increased by 10 percent between 2012 and 2016, with a large portion of that tied to single family home construction. “About one in every five jobs the county has gained has been tied to construction,” Cooke says.

Since Philadelphia is undergoing an economic upswing, the New Jersey counties closest to the city are experiencing a related uptick as well, according to Cooke. Camden’s job base has expanded by 5 percent over the last four years. Job growth in Burlington County, similar to Ocean, is evident in the home construction sector.

Commenting on the vast array of development projects occurring in the City of Camden, many of which are benefitting from New Jersey Economic Development Authority tax incentive programs, SNJDC’s Asselta says the various endeavors “will bring the city back to life as people knew it back in the 1940s and 1950s.”

In late 2015, Subaru of America broke ground for its new headquarters, located adjacent to Campbell Soup Company’s world headquarters. It will total 250,000 square feet, and a second building will comprise 83,000 square feet, more than doubling the size of the company’s current location in Cherry Hill.

Holtec International, meanwhile, will build nuclear reactors and equipment in a new facility enabled by a $260-million tax package approved by the NJEDA. The project, which will generate nearly 400 jobs initially and many more long-term, is rising on 50 acres leased from the South Jersey Port Corp. It will consist of a 385,000 square-foot manufacturing facility, a 55,000 square-foot warehouse and a seven-story 162,000-square-foot office building. Hundreds of construction workers from the South Jersey region are building the project, which is expected to open in 2018. Holtec President and CEO Kris Singh announced in early January that the company will begin relocating staff from its Marlton facility to Camden this month.

Last September, the Philadelphia 76ers opened its 125,000-square-foot complex: a 58,926-square-foot basketball operations building that features two full, NBA regulation-sized courts and a three-story, 66,250-square-foot front office facility that houses business operations. The team announced the move back in 2014, and is receiving $82 million in tax breaks over the next 10 years, as long as 250 jobs are generated at the site.

This year, the $62.5-million Rutgers-Camden Nursing and Science Building is expected to open in the city’s proposed “eds and meds” corridor. Next year, a $51-million Joint Health Sciences Center is expected to open its doors.

In mid-December, Liberty Property Trust announced it would start construction of the first phase of its $1- billion, mixed-use complex in the city.

Port Side

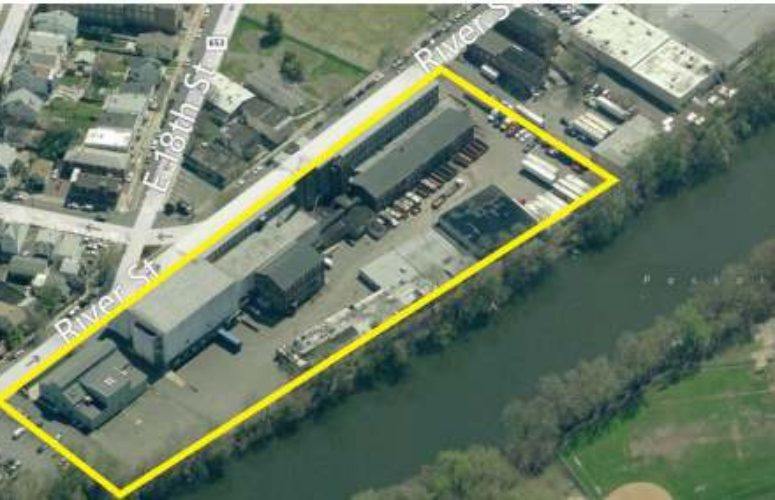

Regarding the port industry along the Delaware River waterfront, Kevin Castagnola, CEO and executive director of the South Jersey Port Corporation, says overall business is expected to increase for the third consecutive year at its various facilities: the Joseph A. Balzano and Broadway Marine terminals in the Port of Camden; the Salem Marine Terminal; and the new Paulsboro Marine Terminal.

In 2015, these terminals increased tonnage by 12 percent over 2014 to 2.5 million short tons. Overall breakbulk cargoes consisted of steel, calcium chloride, cocoa beans, fruit and wood products.

A study conducted in 2010 on the economic benefits the SJPC provides directly and indirectly revealed that some 24,605 residents in the Delaware Valley region were linked to cargo and vessel activity at the terminals. Cargo movement generated 2,446 direct jobs and another 1,132 people were employed providing goods and services the direct job holders.

Though there are no figures for 2016, Castagnola says the 2010 numbers could easily be increased by “50 percent to 65 percent … maybe 75 percent.”

A major boost to the port region is the opening of the Paulsboro Marine Terminal, the first major port to be constructed on the Delaware River in more than 50 years. Holt Logistics is operating the port under the name Paulsboro Waterfront Development. The $170-million project is a 190-acre development with a deep water birth and 21,000 feet of rail track. The first tenant is NLMK, a slab company that is expected to import a million-and-a-half-tons of slab to its facility at the site. Its first vessel is expected to arrive this month.

With the opening of Paulsboro, Castagnola says the first order of business is handling 1.2 million to 1.3 million tons of steel.

In other news, the Camden port is being dredged to 45 feet. To be completed by the end of 2017, the deepening will allow bigger vessels into the port. “This puts us in the ball game to do more business,” Castagnola says.

Commercial Real Estate

South Jersey’s commercial real estate front is a tale of two sectors: Industrial and office. While the former sector is showing signs of strength, led by large retail and e-commerce businesses seeking to increase capacity and improve their supply chain with state-of-the-art facilities, the office sector is still recovering from the impacts of the Great Recession. However, signs of life have begun to emerge.

Thomas J. Heitzman, president of Delran-based Whitesell Construction Co., Inc., says meaningful gains in the office sector weren’t realized until 2015. “During this time, we made some leading deals with companies that took advantage of the opportunity to trade up to higher quality space while market rates were low,” he says. “At the same time, some of the gains were offset by larger users reducing square footage when their leases were up for renewal.”

On a positive note, Heitzman sees more activity in the 5,000- to 15,000- square-foot range for the office sector, with many existing Whitesell customers expanding their spaces. The majority of office activity has been in the defense and financial services sectors, which are typical users of Class A space.

On the industrial front, Heitzman says the sector started its recovery from the recession in late 2011. “In the last few years, demand has accelerated significantly, led primarily by build-to-suit and speculative ‘big box’ development along major thoroughfares such as the New Jersey Turnpike and I-295. Within the last several months, we are seeing small companies taking new or increased space within existing portfolio availabilities,” he says.

Heitzman agrees with SNJDC’s Asselta that there is plenty of available land in Southern New Jersey. “In fact, Southern New Jersey is pretty much the only place left in the state with land parcels large enough to develop major 500,000-to-1-million-square-foot distribution facilities with good access to major highways. However, the challenge is that much of the available land is agricultural and lacks utility and modern roadway infrastructure – things that require significant investment beyond the cost of the land itself.

“It will take time, capital investment and cooperation from the government – and continued growth in the economy – to get that infrastructure in place in order to realize South Jersey’s full developmental potential,” Heitzman says.

As for Whitesell, it is the largest privately owned commercial developer in South Jersey, with more than 9 million square feet of commercial property in Burlington, Camden and Gloucester counties as well as Bucks County, Pennsylvania.

Banking on South Jersey

Mike Dinneen, senior vice president and director of marketing, communications & investor relations at Sun National Bank, sees the Southern New Jersey commercial real estate market showing signs of a rebound with vacant commercial properties coming back online. “These are creating opportunities for ancillary businesses, which, in turn, opens the door for unique small business lending and banking opportunities for those small business,” he says.

Overall, Dinneen says Sun National has grown or established significant commercial lending relationships in the manufacturing, retail, hospitality, transportation and service industries in the past year. He even mentions that business customers in Atlantic City are approaching a more normalized operating environment in the post-recalibration of casinos. “Those businesses that were well-run prior to the downturn are finding new ways to adapt, survive and ultimately grow again,” he says.

Dinneen also credits the state and the NJEDA for opening the doors for well-established business to grow, especially in Camden, adding that the state’s business climate is becoming more business friendly.

Asked about Sun National Bank’s expansion plans in the coming year, Dinneen says, “Our primary method of expansion will continue to be investments in technology and talent. We recently completed a rebranding of our locations, which has modernized our network and made our locations more visible. Sun National Bank is a subsidiary of Sun Bancorp, Inc., a $2.19-billion asset bank holding company headquartered in Mount Laurel.

Higher Education

As previously mentioned, SNJDC’s Asselta says higher education is playing a key role in workforce development in the Southern New Jersey region. She specifically mentions initiatives in Cumberland County that combine workforce training and technical education, thanks to the assistance of Cumberland County College (CCC).

In 2015, an official ribbon cutting ceremony marked the opening of the new Cumberland County Workforce and Economic Development Center at CCC. The 30,000 square-foot building serves as a more centrally located resource to assist job seekers and employers.

According to Allison Spinelli, the county’s Department of Workforce Development’s executive director, “Our location on the CCC campus is more convenient for area residents and employers to take advantage of the multiple resources we offer in order to help them reach their objectives.” She adds, “We are now located adjacent to key workforce development partners including the college and the Cumberland County Technical Education Center.”

The new buildings house several departments, including the Cumberland County Improvement Authority’s (CCIA) Economic Development Services, the New Jersey Small Business Development Center, the New Jersey Department of Labor & Workforce Development, and the Cumberland County Office of Veterans Affairs.

At the South Jersey Technology Park (SJTP) in Mantua Township, part of the 580-acre Rowan University West Campus, Asselta (who sits on the SJTP board) says an international company is poised to occupy a second building at 180-acre park. “There is the opportunity for that company to be involved with Rowan University, which is becoming more and more of a research university every day,” she says. “The marriage between private industry and higher education in our region is the way to do business.”

The SJTP’s mission is to establish a technology-based entrepreneurial economy. The facility provides competitively priced Class A facilities for start-up and established companies that bring innovative technologies to the marketplace, and serves as a home for tech-focused researchers, inventors, entrepreneurs, professors and students.

Meanwhile, Rowan University continues expanding its Rowan Boulevard project, which has linked the university with Glassboro’s downtown retail district. The one-third mile corridor is lined with shops, restaurants and medical providers at street level with housing, offices and classrooms on the floors above. Approximately $400 million will have been spent on the project between 2009 and 2018, according to Joe Cardona, vice president for university relations at Rowan University.

Not including the Boulevard project, Cardona says the university has spent $323.5 million in construction projects on campus since 2011. “A new $63.2-million business building and $70.6-million engineering building opened last month,” he says. “We just opened a $145-million, 1,400-bed residence hall built through a public-private partnership (no Rowan money). The construction of the new buildings for engineering and business allowed us to double enrollment in those colleges. More students graduating in those high-demand disciplines gives companies access to a quality talent pool.”

Looking forward, Cardona says Rowan is expected to spend another $228 million in construction by 2024.

Conclusion

This article may skim the surface of what is fully going on in Southern New Jersey in terms of economic development. However, it should give the reader the impression that the region is open for business. Asselta says all eight-county economic development leaders are dedicated to attracting new businesses when she says, “Every county that I work with has excellent professionals who will lead a prospective business where it wants to go and where it needs to be.”

ACEA’s Slusher sums up the effort and spirit best when he says, “We are here … we are not going anywhere … and we are going to fight and make this work!”

Related Articles: