Should Your Business be ‘In the Zone?’

Discover the benefits offered by Opportunity Zone, Foreign Trade Zone, and Urban Enterprise Zone programs.

By Anthony Birritteri, Editor-in-Chief On Nov 27, 2019In sports, being “in the zone” means being in the present moment and performing at peak levels. Activity becomes a Zen-like function as skill, training and mental discipline come together. You are on autopilot as the consciousness of what you are doing, disappears.

In the realm of New Jersey economic development, being “in the zone” may not be such a transcendental experience, but still, it’s a positive thing.

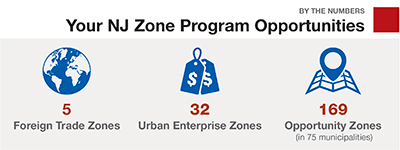

In this article, we look at three business “zone” programs that deliver tax advantages and other benefits to participants. They include: the federal Opportunity Zone and Foreign Trade Zone programs and the state’s Urban Enterprise Zone program.

Opportunity Zones

As part of the 2017 federal Tax Cut and Jobs Act, the Opportunity Zone program – championed by Senators Cory Booker (D-NJ) and Tim Scott (R-SC), and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI) – allows investors to reinvest their unrealized capital gains tax liability into a dedicated Opportunity Fund. This fund capital must be invested in a business or real estate project located in one of the state’s 169 Opportunity Zone Census tracts located in 75 communities across all 21 counties. These areas or tracts are in low-income rural and urban communities.

According to Leslie A. Anderson, president and CEO of the New Jersey Redevelopment Authority (NJRA), “The Opportunity Zone program was created to generate private investment in places where we normally don’t see investment. Meanwhile, the opportunities are limitless, as the capital gain tax liability across the nation is in the trillions of dollars.

“These cities and tracts that have been neglected or passed on in terms of economic development now become players in the game because they can access capital at a greater level,” Anderson continues. Candidly, she adds the state “would love to fund every project that comes across its table, but whether you want to admit it or not, [our] resources are limited.”

In the program, an investor’s capital gains are deferred from taxation until he or she exits from a Qualified Opportunity Fund or by December 31, 2026, whichever comes first. Taxes on the capital gains are discounted based on how long the investment is held. For five years, the discount is 10%; seven years, 15%; and at 10 years, the investment is permanently excluded from the capital gains tax.

“After the 10-year period, the investor gets the liability written off, gets principle back from the investment, and in some cases, gets a rate of return,” Anderson explains. Of course, the program is new, so no one has experienced any of the above scenarios.

Opportunity Zone investors interested in finding out about zones in the state are able to access the New Jersey Opportunity Zone Marketplace at www.oppsites.com/newjerseymarketplace. Launched by the New Jersey Economic Development Authority (NJEDA), this online portal connects international investors with business investment, real estate and community improvement projects in the state’s 75 Opportunity Zone municipalities.

Foreign Trade Zones

Foreign Trade Zones (FTZs) are secure areas under the U.S. Customs and Border Protection (CBP) supervision located in or near CBP ports of entry. Businesses located in these zones, five of which are in New Jersey, pay no duties on merchandise imported for manufacturing or assembling, when the final product is exported outside the US. Duties are only paid when these products leave the zone for the domestic market. Additionally, there are no duties paid on merchandise shipped from one FTZ to another.

According to the most recent US Foreign-Trade Zones Board Annual report, which covered the period from January – December 2017, there were more than 90 companies using FTZ procedures across New Jersey’s five (5) zone projects: FTZ #44, whose grantee is the State of New Jersey; FTZ #49, whose grantee is the Port Authority of New York/New Jersey; FTZ #142, whose grantee is the South Jersey Port Corporation; FTZ #200, whose grantee is Mercer County; and FTZ #235, whose grantee is the Township of Lakewood.

According to Melanie Willoughby, executive director of the New Jersey Business Action Center (NJBAC), in 2017, New Jersey was ranked 15th in FTZ merchandise received and 17th in FTZ merchandise exported out of all 50 states. “The key reason for the state’s active FTZ usage is the combination of high-volume cargo shipments moving in and out of seaports and airports in the greater New York City metropolitan area and the proximity of those import/export gateways to major population centers in metropolitan New York, Philadelphia, and Washington, DC,” she says.

Companies that important and export products across a broad range of industries may benefit using the FTZ program. Willoughby explains that in the current US trade policy environment, where significant additional Customs duties are assessed on certain products imported from certain countries, the benefits of the FTZ program may become even more attractive to businesses. However, the FTZ program is not well-known to the majority of US businesses involved in international trade.

This is unfortunate because besides the Customs duty benefits, the FTZs also provide logistics and administrative benefits as well. “The retention and expansion of these FTZ-supported business activities in New Jersey results in significant positive economic impacts such as direct and indirect employment, stable and increasing tax bases, and the ongoing use of spin-off local and regional products and services,” Willoughby says.

For more information on FTZs in the state, visit www.nj.gov/njbusiness/international/foreigntradezones/

Urban Enterprise Zones

New Jersey’s Urban Enterprise Zone (UEZ) program was enacted in 1983 to help spur economic development in distressed municipalities by offering participating businesses located in zone areas tax benefits, including sales tax purchase exemptions and corporation business tax credits. There are 32 active zones in 37 municipalities throughout the state and more than 6,300 certified UEZ participating businesses.

Benefits to UEZ businesses include: Charging half the standard sales tax rate on certain purchases; tax exemptions on certain purchases including capital equipment acquired and investments made to build a new facility, expand or upgrade an existing facility; for each new permanent full-time employee hired, businesses may receive a one-time $1,500 tax credit; a tax credit against the corporate business tax up to 8% of qualified investments within the zone; eligibility for priority financial assistance; subsidized unemployment insurance costs for certain employees who earn less than $4,500 per quarter; electricity and natural gas sales tax exemption on consumption by manufacturing firms with at least 250 employees, more than 50% of whom are in a manufacturing process.

For more information on the state’s UEZ program, visit www.nj.gov/dca/affiliates/uez/

These programs are just a few of the many business and economic development incentives being offered by the federal government and the state of New Jersey.

While “zoning issues” may have negative connotations when it comes to the difficulties one may experience in locating a business, the positive zoning issues in this feature may help a company reach its economic nirvana.

To access more business news, visit NJB News Now.

Related Articles: