New Jersey Wants to be a Hub for Innovation. How does it compare?

NJBIA’s updated Indicators of Innovation report compares New Jersey with neighboring states based on capital, talent and business performance.

By Kyle Sullender, Director of Economic Policy Research, NJBIA On Jun 8, 2022The role that innovation plays in economic growth has been long established by economists. Innovation drives gains in productivity, leading to the production of more goods and services, and thus a growing economy. While the United States spends more on research and development than any other country, states that generate and harbor innovation enjoy significant benefits.

For these reasons, the New Jersey Business & Industry Association (NJBIA) has sought to elevate the Garden State’s status as a hub of innovation and development, and a magnet for entrepreneurs and high-growth enterprises. With this in mind, NJBIA has spent years tracking and analyzing a set of core “indicators of innovation” in three areas: capital, talent and business.

Capital represents opportunities for investment, whether through venture capital, federal grants and awards, or state spending directed at research and development; Talent measures the state’s ability to generate an innovation ecosystem through a highly skilled workforce, the quality of its institutions, and the number of entrepreneurs seeking to develop new businesses in the state; and Business evaluates whether the state is competitive enough to attract and retain the innovative businesses it seeks to cultivate.

MA, NY Still Lead

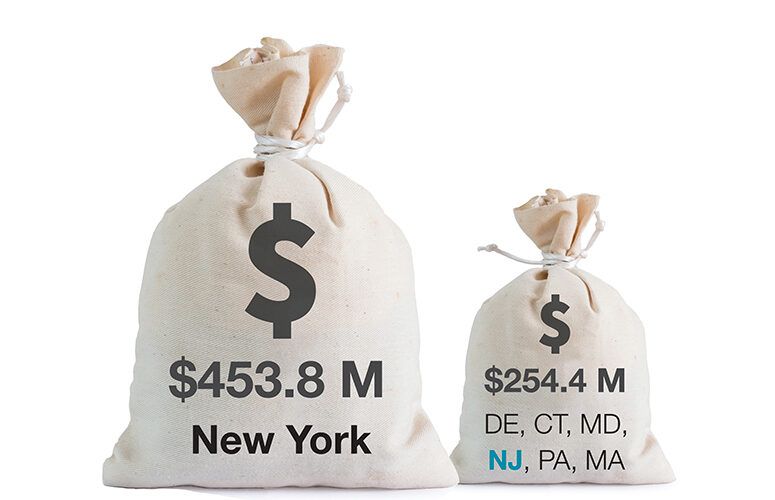

Little has changed at the top of the rankings since NJBIA’s first report in 2019. Based on a preliminary updated analysis, Massachusetts and New York continue to lead the region by a sizable margin in NJBIA’s scoring system. The results are of little surprise considering that both states are home to numerous top institutions of higher education, receive hundreds of millions of dollars in federal research and development grants and awards, and rank among the top states nationwide for patents granted to inventors.

The two states are part of a dominant triumvirate that includes California. New York alone outspends the rest of the region on R&D, and, for the second consecutive year, according to the National Venture Capital Association, Massachusetts, New York and California accounted for 84% of total venture capital assets under management (AUM) in the United States in 2021. Venture capital AUM measures the value of all assets being managed in a state by venture capital funds, though those funds won’t necessarily be invested in projects located in the same state.

Maryland, New Jersey Continue to Jockey

Maryland and New Jersey continue to shift positions in NJBIA’s updated preliminary regional rankings. New Jersey had narrowly surpassed Maryland in the 2020 study, but trails the Old Line State in an updated analysis. Maryland saw improvements primarily in Capital indicators, specifically with regards to AUM, SBIR/STTR award obligations, and state R&D expenditures.

Although New Jersey’s overall position in this year’s analysis is slightly behind its previous rank, there have been positive steps forward with regards to several of the recommendations outlined in the 2020 report. Funding for the Commission on Science, Innovation, and Technology increased in FY22, and the state created the New Jersey Emerge Program in 2021 to provide corporate tax incentives intended to help attract and retain businesses, as well as encourage in-state growth.

Additionally, the New Jersey Economic Development Authority (NJEDA) Board recently approved the creation of the New Jersey Innovation Evergreen Fund, a public-private partnership, which will make the state an equity investor in startup companies alongside professional venture capital groups.

The state has made progress in several areas that will be critical to long-term growth and innovative capacity, even if those changes haven’t immediately impacted the state’s standing in NJBIA’s ranking. Still, further reforms are needed to cultivate the innovation ecosystem New Jersey is capable of producing, and more can be done to incentivize investments in high-growth companies or research and development in strategic sectors.

About the Author: Kyle Sullender is director of economic policy research for the New Jersey Business & Industry Association. He is also executive director of Focus NJ, an independent research non-profit conducting timely, innovative, nonpartisan economic and workforce research to support sound public policy in New Jersey.

To access more business news, visit NJB News Now.

Related Articles: