New Jersey Economic Recovery Act Signed

New incentives program better supports small businesses.

By Anthony Birritteri, Editor-in-Chief On Feb 5, 2021The state has a new economic incentives program with the signing of the $14.4-billion New Jersey Economic Recovery Act of 2020 this past January.

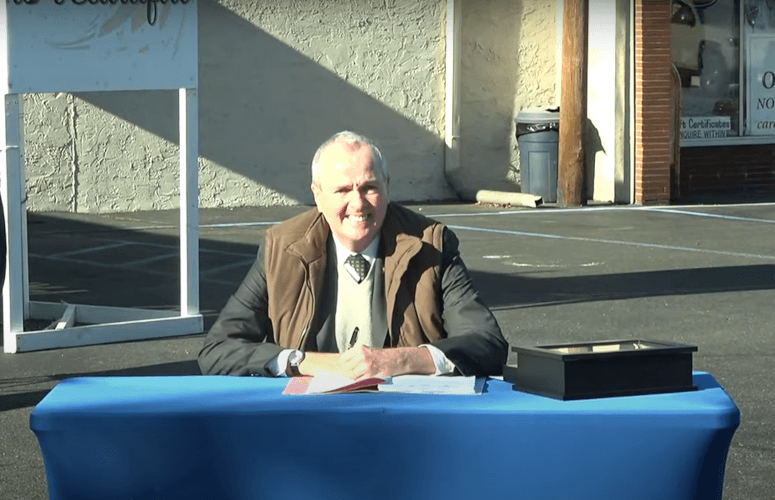

At a ceremony at Carella’s Chocolates & Gifts in Hamilton, Gov. Phil Murphy said, “We built this program on the twin pillars of transparency and fairness to fuel the creation of good paying, future-focused jobs and to ensure sensible spending caps and strong safeguards to protect taxpayers and communities.”

Adding that the new program is not just tax incentives for large corporations, Murphy added, “Our future rides on the backs of our small businesses that employ the majority of our residents, especially those owned and operated by women, people of color, and veterans.”

As an example of this assistance, he said the incentive package’s Main Street Recovery Program will provide a direct $50-million appropriation for grants, loans, loan guarantees, and technical assistance to small and micro businesses.

Under the legislation’s Aspire Program, redevelopers can receive tax credits to cover certain project financing gap costs. Along with the Emerge Program, $1.1 billion has been allocated for programs less than $100 million in value. Projects larger than $100 million will be considered transformative and are subject to an overall cap of $2.5 billion.

For high-tech startups, Murphy said the program’s NJ Evergreen Fund, which pairs state resources with private venture capital investments, is a “game changer in our efforts to remake New Jersey into the global center for innovative new businesses.”

Meanwhile, the Ignite program provides grants to collaborative workspaces in order to support the early month rents of innovative startups.

Other programs Murphy discussed included the state’s first historic preservation tax credit that will repurpose historic buildings. The Act also includes a food desert alleviation program, a brownfields remediation program, and a program that provides up to $200 million annually to support anchor facilities such as hospitals, education and arts/cultural institutions.

Additionally, there is a: Personal Protective Equipment (PPE) program that provides tax credits to qualified facilities manufacturing PPP; an additional $200 million in tax credits added to the existing film tax credit program; and amendments to the existing Angel Investor Tax Credit program, adding a new classification for minority- and women-owned businesses and expanding the tax credit up to $35 million annually.

All of the programs in the legislation have a combined incentives cap of $1.5 billion. Per-job credits and total credits per business are also capped. However, these are multi-year caps that allow flexibility through rollovers or borrowing.

According to Michele Siekerka, president and CEO of the New Jersey Business & Industry Association, “We believe this is a comprehensive and balanced plan that comes at a most opportune time, as we work to recover from the pandemic. We are encouraged by the flexibility, depth and richness of the programs, with an emphasis on high-growth industries, ample opportunity for transformational projects, and checkpoints to ensure projects are benefitting our great state.”

She added, “With an economic plan of such enormous scope, there are always areas that can be improved upon and we hope there will be further assistance for our challenged Main Street businesses.”

“Going forward, NJBIA will continue to encourage revisits of the programs by our policymakers to ensure there is an appropriate balance of opportunity for businesses of all types and sizes in New Jersey,” Siekerka said.

To access more business news, visit NJB News Now.

Related Articles: