International Banking

Banking products and services, combined with expert advice, help pave the way for global commerce.

By George N. Saliba, Managing Editor On Mar 7, 2016In an increasingly global economy, even those New Jersey companies that do not offer their products and services overseas may find themselves at least sourcing from foreign-based companies, due to pricing and/or other advantages.

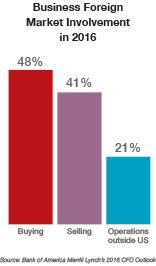

Overall, Bank of America Merrill Lynch’s 2016 CFO Outlook (a survey of middle market CFOs), reveals that 61 percent of respondents will have some foreign market involvement in 2016, whether buying from foreign markets (48 percent), selling to foreign markets (41 percent) or having operations outside the US (21 percent). Bob Arth, executive vice president, global commercial banking at Bank of America Merrill Lynch, tells New Jersey Business, “We prepare and advise our clients for any of these scenarios that will help grow their companies, recognizing that many of them will be entering a new jurisdiction for the first time. So, our knowledge and guidance can be invaluable.”

Indeed, small businesses and – perhaps surprisingly – middle-market companies, often lack international business expertise, and are rightfully wary of business transactions in countries where legal systems may be unreliable and/or corrupt, and they “don’t really know whom they are dealing with.” Esteemed banks can not only facilitate international commerce via a wide variety of products and services, but also through their general expertise.

Banking Products and Services

In the realm of international banking products and services, one common service is a letter of credit, which essentially guarantees that a US or foreign company will pay a seller under specific conditions, and, if a party fails to make a payment, the bank will nevertheless do so. Clean import loans – defined as “loans granted to an importer for payment of import bills, without the bank having any claim to the goods” – are also popular.

Andrew Moy, eastern division manager for Wells Fargo’s global banking group, underscores, “Companies that are just getting started with international services often need basic services including international accounts for payments and collections, trade services such as import/export letters of credit and foreign exchange. They can also get help from the [US Small Business Administration], or the recently reauthorized Ex-Im Bank to get funding to support their international growth plans.”

He adds that when a business has both payables and receivables denominated in the same foreign currency, a multicurrency account can be an effective solution. The account allows funds to be deposited, held, and paid in that foreign currency without conversion to US dollars. These funds can then be used to initiate foreign payables online, by check or wire. Moy says that multicurrency accounts can essentially take the rate fluctuation risk out of the equation and make foreign purchases and sales easier and more flexible when transacting in the same foreign currency.

Regarding foreign exchange risk, if a company is constructing a manufacturing plant in Mexico, it may have the correct terms, may be purchasing at reasonable rates, and have confidence in a supplier, and yet – if it is attempting to do this in US dollars – the company is potentially not experiencing a premium transaction, since the transaction costs are in US dollars. Whether a company converts dollars to another currency before the purchase, or the seller changes it afterwards, it is taking some currency risk. Second, if a business is manufacturing in Mexico, for example, a company may want to borrow against its assets in Mexican pesos, rather than borrowing in the US, sending funds to Mexico (based on its US assets, or US guarantee). This method may help with both tax issues and the repatriation of funds.

Technology

On the topic of banking technology, Martin Richards, head of middle market commercial banking for HSBC Bank in the United States, says, “We can go to HSBCnet, which is an Internet product, and it allows companies to see all their different accounts around the world, with the different banks or branches of HSBC. You can convert that back to dollars; you can move it around. It really gives a middle market company the capabilities that large-cap multi-nationals used to wish they had, a long time ago. Of course, when doing this, a company would open accounts with a bank in Brazil, for example, and then they would go to China and open accounts with another bank. Then, they would go to India, and do the same thing. A company [used to have to] kind of manually track deposits, when they came into a [computer] system. Now, with some of the Internet products we have, you can actually see and move money around the globe – even when it is not with HSBC. I think it gives a treasurer, or a CFO back in New Jersey, comfort. Obviously, with supply chain command change, you can use the Internet to track your sourcing and flow of your goods through the supply chain, which makes you more efficient.”

Foreign Country Expertise

Of course, the US Department of the Treasury publishes its Specially Designated Nationals List (SDN), which lists individuals, companies, groups and entities (including terrorists and narcotics traffickers), which US persons are generally prohibited from dealing with. While this may sound outside the realm of most transactions, New Jersey Business magazine’s international law article once related the very real predicament of an attorney and client who sought $15 million in paid-for goods from a Russian company, but whose quest ended when they realized it was not a legitimate company, but rather a crime syndicate.

All told, New Jersey businesses will want to ensure that their business partners are reliable and honest, and this may be achieved via a host of means, including, but not limited to: checking references, consulting with professionals and verifying the party’s track record.

In even broader terms, HSBC’s Richards, says, “We actually give our clients advice not just on financial products, but on the country risk, and doing business in that country. For example, I have a client in Philadelphia in the construction industry. They had a lot of large contracts in the Middle East, and these [specific] countries are not at war, but, with all the things going on in the Middle East, a lot of the other banks that were talking to this client felt like: ‘I am not sure we can do any business with you; I am not sure we can lend you any money; I am not sure what we can do.’ This is a very stable company, and I actually met with its CFO several weeks ago, and [I said]: ‘We have lots of business in these countries. So, when you are doing something in Amman – or wherever it might be – Saudi Arabia – we don’t get nervous just on a lack of knowledge, because we are already doing business there, ourselves.’”

Richards adds that HSBC can educate its clients about what it is truly like to do business in a particular foreign country. For instance, in the Middle East, there are at times individuals who “skip,” meaning they depart suddenly via airplane to avoid a business commitment. Richards explains, “That’s not something that we really experience in the US – skipping out and flying to Europe, or wherever – but, in certain locations, because of the political or legal systems there, this happens. The more we can educate clients as they go in, [the better]. We [as a bank] may have been there 100 years, and [the customer] may have been there 100 days.”

Bank of America Merrill Lynch’s Arth, adds, “We help our clients understand the jurisdictions in which they operate and create a strategic plan that accounts for their risk appetite in those countries where political or financial instability or volatility are more challenging. We consider the clients we will bank, their business operating model and the product selection we can support to ensure we’ll operate a consistent business practice that our clients can rely on for stability, as well as expertise as they venture into these more challenging economies.”

Conclusion

Overall, HSBC Richards’ concludes, “[If companies do not] become internationalized, it is probably going to be very hard for them to compete, even if they are of a relatively small size. I think the vast majority of industries and companies of any size [are involved with] global import, or global risk, or global sourcing, [etc]. It is incumbent on all companies to be thinking about this, either as an opportunity, or a kind of a risk that they communicate.”

Related Articles: