Getting Down to Business

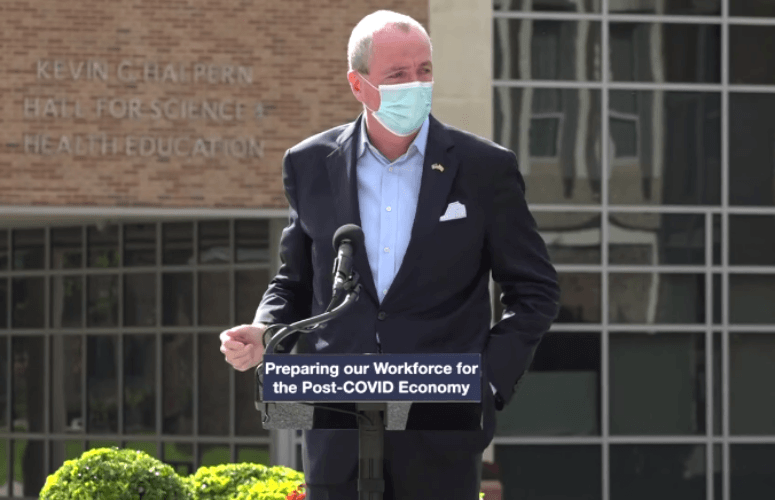

By Michele N. Siekerka, NJBIA President and CEO On Dec 29, 2021This month ushers in a new two-year session of the Legislature with newly elected lawmakers, new leaders in the Senate, and a new four-year term for Gov. Phil Murphy. But will this new beginning produce the same old approach in Trenton, or policies with greater emphasis on the survival of New Jersey businesses and the jobs they provide?

My heart goes out to employers for the challenges they have had to deal with over the past two years because of the pandemic. Government-ordered closures of non-essential businesses may be behind us, but New Jersey employers now grapple with unprecedented workforce challenges. These include a labor shortage (despite New Jersey having the third-highest unemployment rate in the nation) as well as supply chain disruptions that have undercut employers’ efforts to sustain and grow their businesses.

As New Jersey’s government gets ready for its biennial changing of the guard, NJBIA will be pressing state policymakers to prioritize resources and programs that New Jersey businesses need.

For example, the bill expanding the childcare tax credit for the 2021 tax year that Gov. Phil Murphy recently signed into law was a good start because it makes it financially possible for more working parents, especially mothers, to rejoin the workforce. However, in order for employees with young children to continue working, the childcare tax credit expansion must extend beyond the 2021 tax year. NJBIA urges the Legislature to address that.

New Jersey’s small business owners are hurting. Too many have been unable to access state COVID-19 economic relief programs because of limiting criteria and lack of funds. Recently, the governor submitted a plan to the Legislature that proposed using $252.6 million of New Jersey’s $6.2 billion in federal American Rescue Plan Act (ARPA) monies for COVID-19 economic relief, but that plan lacks any direct expenditures for New Jersey’s small business community.

NJBIA will be redoubling its efforts to see that more federal ARPA dollars reach New Jersey small businesses, which collectively provided jobs for 49.8% of the state’s private-sector workforce before the COVID-19 pandemic struck. Small businesses must be the 220th Legislature’s priority when it begins its new session on Jan. 11.

New Jersey’s high taxes and affordability challenges dominated the political debate in the last election, and we hope state officials show that they have heard voters’ message by saying no to tax increases and costly new business mandates. The focus for 2022 must be recovery and reinvention so that our businesses have the resources to survive these trying times and emerge stronger on the other side.

To access more business news, visit NJB News Now.

Related Articles: