GDP Grew Steadily in 2021

By Kyle Sullender, Executive Director of Focus NJ On May 31, 2022After a year of record-high unemployment, rapid GDP fluctuations, and personal income spikes driven by unprecedented stimulus, stability finally returned to New Jersey’s economic indicators in 2021. Measures of the state’s fiscal health and well-being lagged prepandemic levels in many instances, but avoided the extremes of the pandemic’s first year.

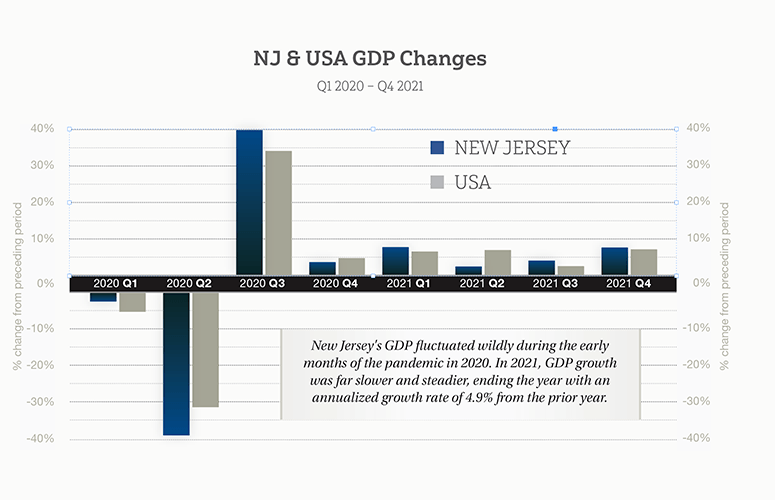

GDP by Quarter: New Jersey’s GDP fluctuated dramatically during the early months of the COVID-19 pandemic in 2020. From Q1 to Q2 of 2020, GDP in the Garden State fell 38.9%, only to rebound in Q3 by 39.5%.

The state’s GDP growth in 2021 was far steadier. In Q1, GDP grew by 7.5% from the preceding quarter and totaled $649.3 billion in current dollars. Growth was slower in Q2 at 2.2% and trailed the national growth rate of 6.7% before picking up slightly in Q3 (3.8%) and Q4 (7.4%).

According to the Bureau of Economic Analysis, New Jersey ended 2021 with an annualized growth rate of 4.9% from the prior year.

Industry Contributions: In 2021, New Jersey’s largest industry as a percentage of total GDP was finance, insurance, real estate, and leasing. The industry’s GDP total was $150.7 billion in 2021 and accounted for approximately 22% of New Jersey’s GDP.

In terms of contributing to the state’s GDP, professional and business services accounted for the second largest segment (16.6%), followed by government and government enterprises (9.9%), manufacturing (9.5%) and educational services, healthcare, and social assistance (9.2%).

Small Business and Consumer Spending: Since the onset of the pandemic, Harvard University’s Opportunity Insights Economic Tracker has attempted to quantify the impact of the pandemic on states, small businesses, and consumers.

According to the Economic Tracker, the number of small businesses open in New Jersey was 8.8% lower at the conclusion of 2021 (the week ending Dec. 26, 2021) than in January 2020. Interestingly, small business revenue measured during the same period increased 31.5%.

The conflicting findings appear to suggest an unequal recovery for small businesses in New Jersey, one wherein many were forced to shut their doors, while others were able to capitalize on consumer spending that remained 34.4% higher at the end of December than it had been before the pandemic

To access more business news, visit NJB News Now.

Related Articles: