Economic Predictions for 2024

What does the economy have in store for businesses in the new year?

By Jim Pytell, Managing Editor On Jan 2, 2024No matter how you slice it, 2023 was a rough year for businesses. Plagued by record inflation, many New Jersey businesses suffered a notable decline in sales and profits, all while contending with the usual challenges of finding workers, and the continued rising costs in areas such as healthcare and energy.

As the state’s businesses turn the calendar to 2024, the outlook remains negative overall, though seemingly not as bleak as it was entering 2023.

“While it’s clear businesses are still struggling with inflation and the increased costs of running their operations, it does appear that last year represented a low water mark that we’re hopefully crawling out from,” says NJBIA President and CEO Michele Siekerka. “That’s not to say the 2024 outlook is positive overall. There are still many issues our job creators need to contend with, and newer concerns over rising energy costs and mandates. However, if our policymakers can be more proactive in improving our business climate, we can move the needle even more in the right direction.”

Inflation

One of the biggest factors in how the economy will fare in 2024 is what happens with inflation.

Kenneth Kim, CFA, CBE, senior economist and senior director at KPMG, says there has been considerable progress in this area. At press time, the current US inflation rate is 3.2% for the 12-month period leading up to October 2023, according to the U.S. Bureau of Labor Statistics, revealing a sharp decline compared to the 9.1% peak seen in June of 2022.

“Historically, for inflation to come down that sharply, it has typically taken an economic recession,” Kim says, adding that he does not, however, anticipate a recession.

According to Jonathan Hirschfeld, Florham Park managing partner at PwC, the firm’s most recent Pulse Survey revealed that only 17% of executives surveyed anticipate a recession in the next six months, compared to 35% last year.

“A lot of the consumer confidence and sentiment measures have been weakening, yet in Q3, we had GDP up 4.9%, which is an exceptional growth rate. So despite the weak sentiment from consumers, they are still going out and spending. When you are dealing with human behavior, it can be fickle,” Kim adds.

Kim does note that the rate of inflation has been uneven, largely due to the volatility of gasoline prices. “A few months ago, we did hit 3.0% CPI inflation, but it has backed up since. However, the trend is still toward lower inflation in the months and quarters ahead,” he says.

Interest Rates

Currently, the Federal interest rate is 5.25% to 5.5%. The Federal Open Markets Committee established this rate in late July, and at its most recent meeting at the end of October, the committee decided to leave the rate unchanged.

“We do believe the Federal Reserve is finished raising interest rates for this business cycle,” Kim says. “While we don’t expect any rate hikes, [the Fed] has left the door open for additional hikes in case inflation does flare up again.”

Gino Di Saverio, Northern & Central New Jersey market executive at Citizens Bank, echoed these sentiments, adding that some observers are even predicting rate cuts could begin as soon as next May. “That could help reduce the cost of credit and spur economic expansion,” he says.

Labor

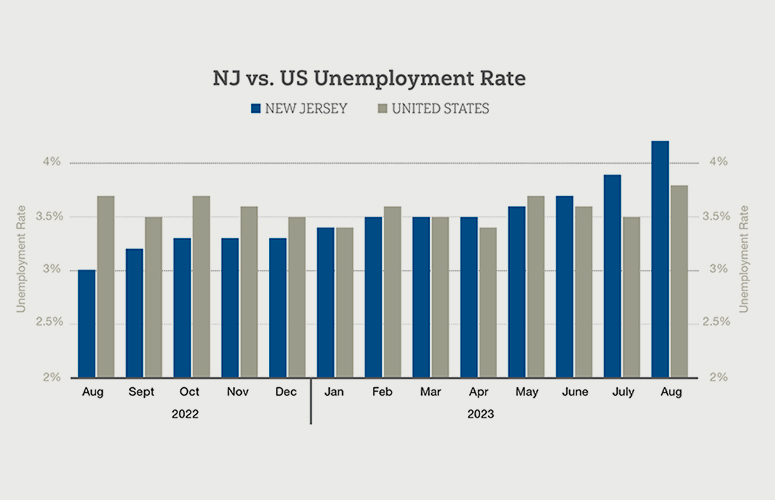

New Jersey has experienced the steepest increase in its unemployment rate of any state in the nation during the past 12 months, according to comparative data from the U.S. Bureau of Labor Statistics.

New Jersey’s unemployment rate, now at 4.6%, has risen 1.3 percentage points from its 3.3% unemployment rate a year prior. Currently, the national unemployment rate sits at 3.9%.

Kim points to layoffs in the banking sector as one of the main contributors to the current unemployment rate.

“The New Jersey labor market remains tight,” says Di Saverio. “Most businesses in New Jersey are still struggling to find, acquire and retain talent. The state has a great pool of talent and workers, but it has just become expensive.”

Hirschfeld adds that businesses are continuing to look for new ways to attract and retain talent.

“We’re seeing businesses move away from traditional job descriptions and organizational structures and focus on skills instead, enabling them to be flexible and responsive to client and business needs,” he says. “With the labor market remaining competitive, we also see businesses building work environments that put employee experience front and center.”

Artificial Intelligence

Additionally, Hirschfeld says that AI’s impact on the labor market could be massive.

“As we look to 2024 and beyond, generative AI will likely continue to shape the business landscape as well as labor. Based on the findings from our Sizing the Prize study on AI’s economic impact, AI could contribute up to $15.7 trillion to the global economy by 2030,” he says, adding that PwC recently invested $1 billion in AI.

International Conflict

According to Di Saverio, armed conflicts may impact the economy in several ways.

“The war in Ukraine has been horrific and has resulted in a slower economic recovery from the pandemic, though most businesses in New Jersey did not directly export to or import from Ukraine and Russia,” he says.

“Of course, the war in the Middle East is also horrific. From a global economic perspective, energy is a key short-run concern related to the Middle East war,” explains Di Saverio. “Oil prices were already elevated at the time of the attack on Israel, and these developments raise the probability of supply disruptions (particularly if the crisis involves Iran or if unrest takes a toll on production in Iraq) and market nervousness more generally. Israel has significant import and export activity with New Jersey and it will affect our economy more, though the war is too recent and we can’t really see its effects yet.”

Election

Additionally, Di Saverio says that election years may introduce policy uncertainty as candidates present different economic plans and priorities. This uncertainty can lead to caution among businesses and investors, potentially impacting investment decisions and economic activity.

“To boost their chances of re-election, incumbent governments may increase government spending or implement fiscal stimulus measures to stimulate the economy,” he says. “This increased spending can have a positive impact on certain sectors and contribute to economic growth.”

Di Saverio says that the biggest policy issues that will have an impact on the economy are how to curb inflation; response to the aforementioned conflicts in Ukraine and the Middle East; political dysfunction; and managing debt levels.

Conclusion

While the outlook for 2024 may not be quite as bleak as it was for 2023, uncertainty and volatility remain.

“Before the pandemic, the economy and financial markets were not as volatile [as they are now],” says Kim. “I think we are entering a world where there will be more volatility, including in geopolitics, and we will not be returning back to the world that we left.”

To access more business news, visit NJB News Now.