Be Ready for Healthcare Open Enrollment

By Michele N. Siekerka, NJBIA President and CEO On Oct 27, 2021November kicks off the open enrollment period for healthcare benefit plans – the perfect opportunity for NJBIA members, especially our small businesses and sole proprietors, to take advantage of one of our most popular money-saving programs.

NJBIA partnered with Association Member Trust (AMT) four years ago to bring our members self-funded health benefit plans that help smaller companies save time, control costs, and pool their purchasing power to access competitively priced plans typically offered to companies with thousands of employees. NJBIA member businesses that have already made the switch have been giving this health benefits solution rave reviews ever since.

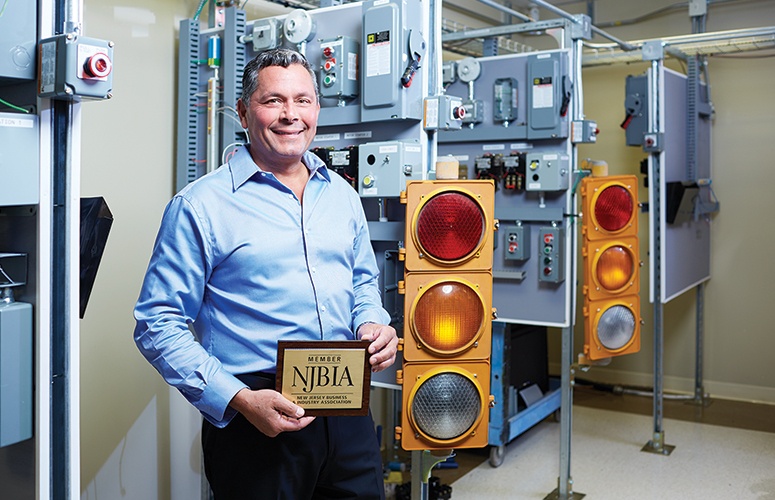

Michele Siekerka, president and CEO, New Jersey Business & Industry Association (NJBIA)

AMT operates under the New Jersey Multiple Employer Welfare Arrangement (MEWA) law and is fully regulated by the State Department of Banking and Insurance. For more than 75 years, AMT has been the oldest and most dependable MEWA available. Today, 2,253 employers who belong to NJBIA, or one of 16 other independent trade organizations, rely on this MEWA for affordable insurance benefits that cover approximately 18,000 individuals.

Healthcare coverage is provided through Horizon Blue Cross Blue Shield of New Jersey and members also have access to dental, group life, and prescription plans. Participants enjoy all the advantages of a large self-funded health plan, claim and cost stability, administrative efficiency, and a full menu of competitively priced plans including Direct Access, EPO, HSA and OMNIA. Through the Blue Cross Blue Shield BlueCard, employers and employees are provided with in-network access to medical providers nationwide.

Most importantly, because AMT is a not-for-profit run for its members, surplus funds are used to improve the plans and, when possible, return annual dividends to members ($18.5 million over the past 10 years). DOBI regulations set a risk-based capital ratio to ensure the MEWA trust remains fiscally sound, and sufficient funds are always held in reserve to pay future claims based on calculations from an independent actuary.

The feedback from NJBIA members who have made the switch has been overwhelmingly positive, especially from small businesses that otherwise would have been forced into the individual marketplace to purchase health insurance. NJBIA members consistently tell me how easy it has been to obtain a free quote from AMT and how “smooth and painless” the AMT signup process has been for them.

COVID-19 has had a far-reaching impact on the mental and physical health of employees. NJBIA’s health benefits solution with AMT provides businessowners with the flexible options they need to keep their workforce healthy and reduce costs at the same time.

Is the MEWA a better health benefits solution for your business? It’s easy to find out on NJBIA’s website at www.njbia.org/sos where you can read more about it and obtain a free online quote from AMT.

And while you’re on our website, check out all the other money-saving programs we offer exclusively to NJBIA members, including HR support, savings on payroll services, high-quality 401(k) and profit-sharing plan solutions, and discounts on products and services from nationally recognized companies that NJBIA employers and their employees can’t obtain anywhere else.

As the nation’s largest statewide employer association, NJBIA’s reputation for the powerful advocacy it delivers in Trenton sometimes overshadows the important resources and money-saving solutions we also provide our members. The healthcare open enrollment period is the perfect time to check out NJBIA’s health benefits solution – and all of our other money-saving programs – to see if how we can help your small business reduce costs.

To access more business news, visit NJB News Now.

Related Articles: