Transwestern: NJ Industrial Market Experiences Best Q1 Since 2008

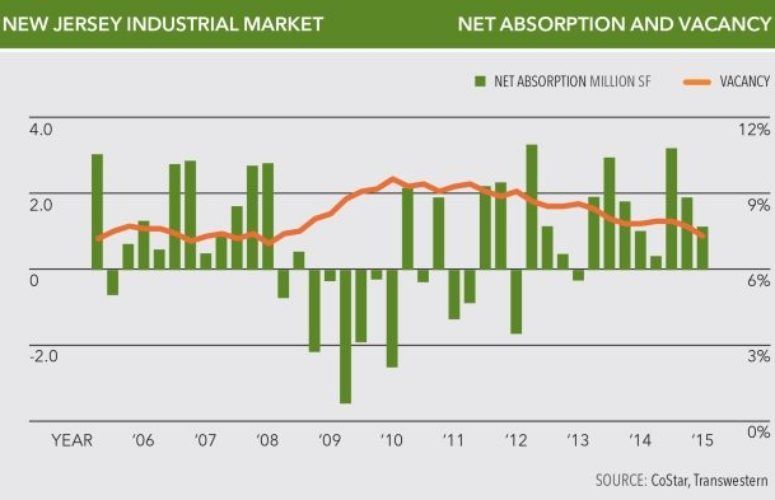

On Apr 24, 2015During the first quarter of 2015, more than 1.1 million square feet of industrial space was absorbed throughout New Jersey – the best opening quarter since 2008, according to Transwestern’s First-Quarter 2015 Industrial Market report. Port concerns in California are expected to prompt a shift in shipping to the East Coast that is anticipated to benefit New Jersey. As a result, Transwestern forecasts the Garden State’s industrial sector will continue to experience economic growth.

“Prior to the office market boom in the 1980s, New Jersey was largely recognized as an industrial state, and history may be repeating itself,” said Matthew Dolly, Research director for Transwestern’s New Jersey office. “Developers are currently doing their part to redevelop depreciated industrial properties, and the state has initiated a number of critical infrastructure improvements. As the transformation of the market continues, New Jersey stands to benefit considerably, especially if shippers consider bypassing the congested West Coast ports.”

Highlights from the report include:

· The 12-month rolling total of square feet absorbed through first-quarter 2015 was 6.6 million – the most since first-quarter 2014, when 7.8 million square feet was absorbed in total, year-over-year. For the past three years, more than 19 million square feet of space has been absorbed.

· Three submarkets reported positive net absorption exceeding 100,000 square feet during first-quarter 2015, with the Meadowlands submarket accounting for nearly 30 percent of the overall activity.

· The overall vacancy rate improved to 7.4 percent, compared to 7.8 percent the previous quarter, decreasing by 40 basis points for the first time since third-quarter 2013.

· Increased leasing velocity has spurred new development to the tune of 10 million square feet during the past three years. Developers continue to seek new opportunities, despite the scarcity of land.

· Double-digit percent rent increases occurred in six of 25 submarkets during the past 12 months, as limited supply and increased demand continue to put upward pressure on asking rents.

· Asking rents in the Exit 13A/Elizabeth submarket are 33 percent higher in a year-over-year comparison, as the vacancy rate has tightened to its lowest level since third-quarter 2006.

“An increasing number of jobs in the manufacturing sector is helping to fill New Jersey’s industrial space,” said Jeffrey Furey, managing director at Transwestern. “This is compounded by the fact that industrial owners are increasingly gaining the interest of some end-users that are being priced out of New York, as New Jersey’s warehouses offer lower costs and more land to accommodate better truck maneuverability and trailer/container storage. The result is an improved vacancy rate for New Jersey’s manufacturing facilities for the second straight quarter.”

Related Articles: